Taking care of yourself and your loved ones should feel like a breeze.

Bowtie is Hong Kong’s first virtual insurer. Our team’s main goal is to make insurance simple and friendly. We believe our customers deserve to find the protection they need quickly. They deserve to purchase the right insurance product easily without breaking the bank. And they should be able to get help easily when facing life’s challenges.

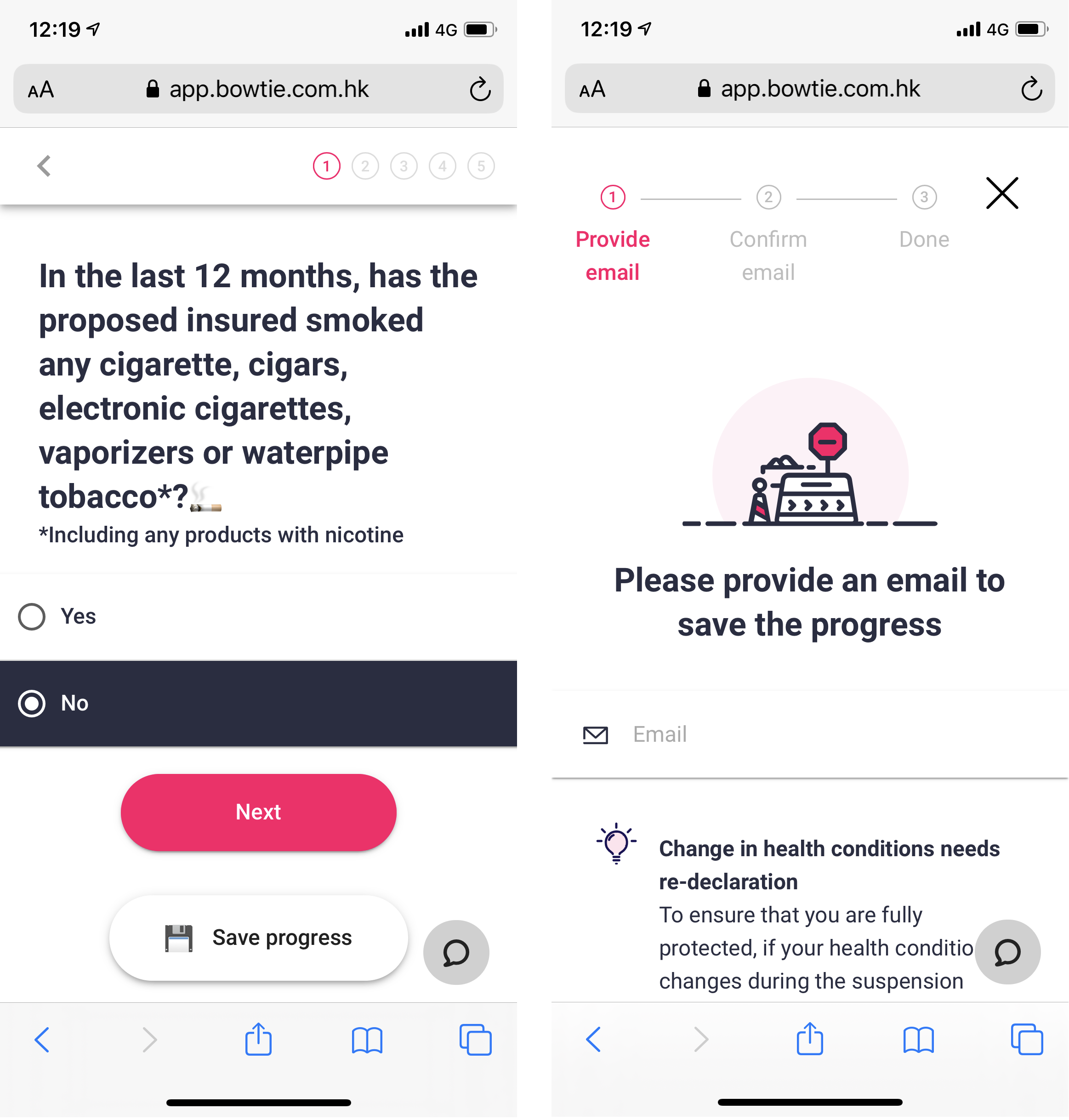

In just 15 minutes, on their smartphone, customers can complete their underwriting process. This is a process that normally takes days! In fact, the user experience is now so seamless that most customers never have to speak to us before buying insurance.

As we continue to grow and launch new products, we want to hear more of our customer’s feedback.

Like most technology companies, our marketing and data teams have worked hard to understand where customers come from, and whether they are having a smooth experience while using Bowtie. But data only goes so far.

We had to put a face to the numbers. Instead of waiting for them to contact us, we decided to reach out to them.

As co-founder and co-CEO, I volunteered to make the phone calls. We emailed a random list of customers with an invitation to speak for 20 minutes. And then we waited.

To our surprise, more than a few customers agreed to speak with me. Several customers were surprised to be invited to speak with an insurance company CEO. Others were just happy to help.

To our surprise, more than a few customers agreed to speak with me. Several customers were surprised to be invited to speak with an insurance company CEO. Others were just happy to help.

Excuse the background noise. I just did a product demo. I’m calling from Asia World-Expo to ask about your experience with us. How are you doing today?

We started out thinking we’d do a few calls. We’ve done more than 100 now. Every Wednesday, no matter what I have scheduled.

Here’s what we’ve learnt.

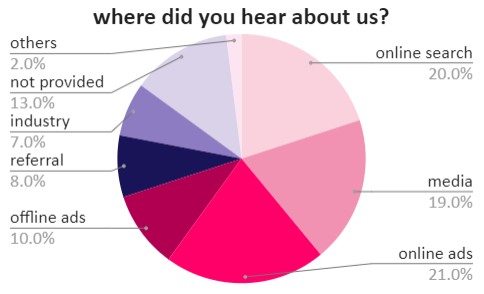

How did you hear about Bowtie Insurance?

A significant share of our customers heard of us on the news (19%), and found us from Google search (20%). Our first product launch was around the time the Hong Kong SAR government officially unveiled the Volunteer Health Insurance Scheme (VHIS). This garnered significant coverage from local and international media.

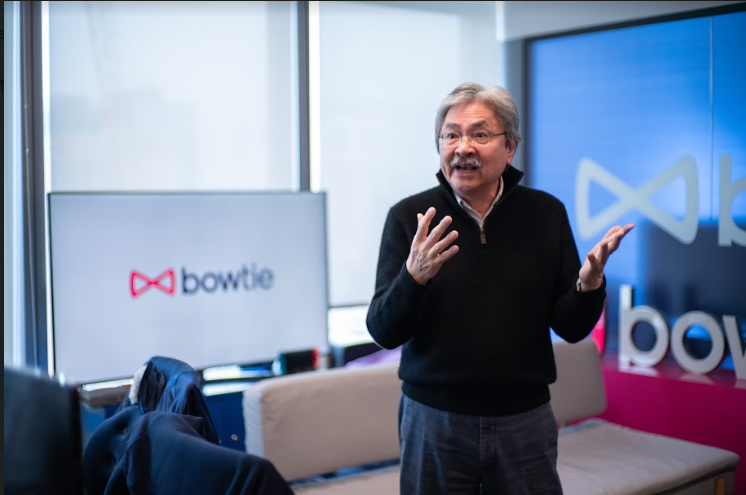

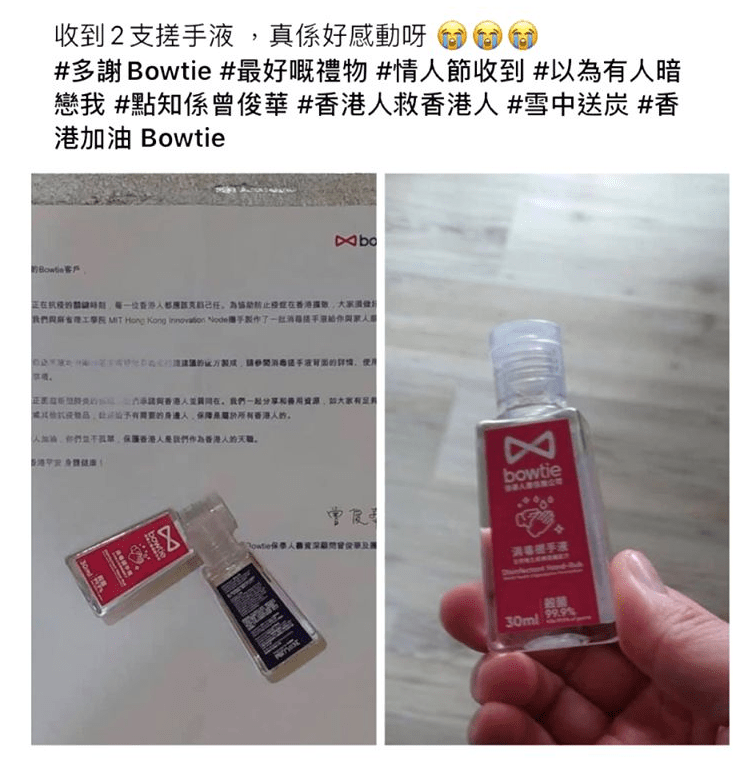

Collaborating with one of our most recognizable supporters – Mr. John Tsang, we launched a series of offline brand campaigns. Our customers remember seeing our pink bow-ties, face masks and hand sanitizers in the street.

Combined with digital ads, customers slowly started to recognize our brand in different channels. When Googling for information related to protection, diseases and health insurance, we became their trusted source of truth.

We also meet many of our customers through partner referrals, and industry conferences. The two largest industries represented are finance and technology.

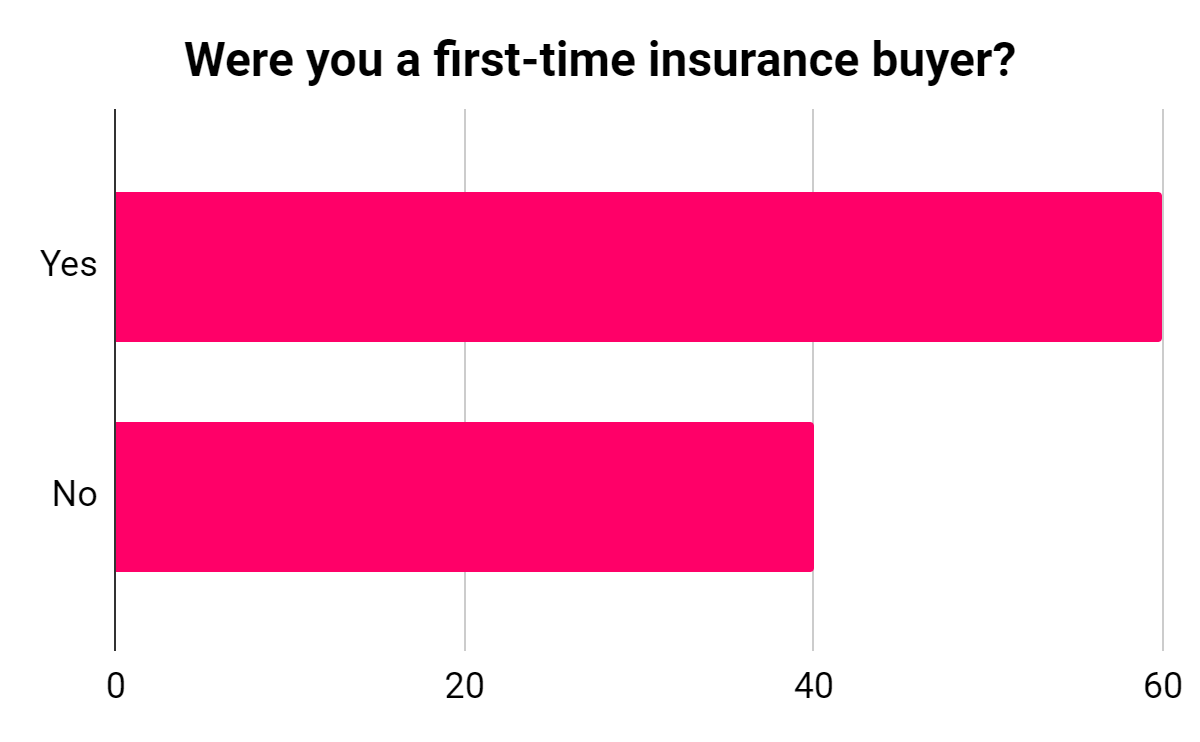

Have you bought medical insurance before?

More than half of the interviewed customers were first-time buyers of medical insurance. This speaks to Bowtie’s ease-of-use. With little to no experience buying medical insurance, customers were still able to complete the online underwriting process.

Of the customers who had purchased insurance before, one-third are buying Bowtie products for their dependents. These may be their parents, spouses, children and siblings. Having worked with insurance agents before, they now have the confidence to pick the right policies for their loved ones.

Getting medical insurance is usually a long and winding process. You may have to declare your medical history, complete several forms, provide personal documents and more.

Bowtie simplifies this process dramatically. It speaks volumes when first-time insurance buyers are able to buy medical insurance on their smartphones without needing any help.

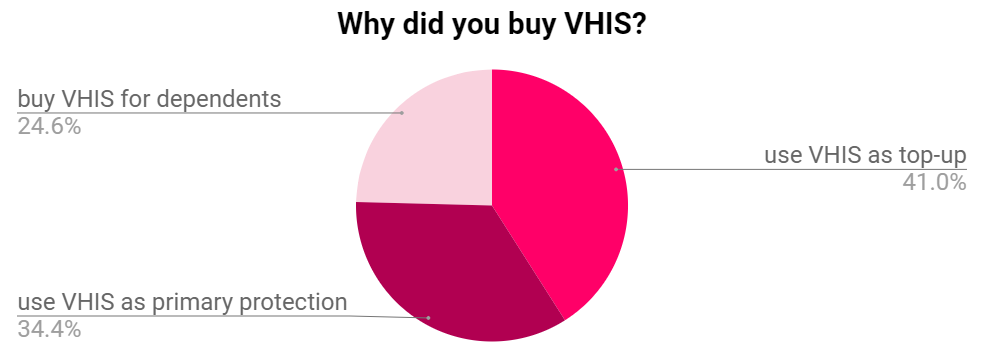

Why do you need medical insurance?

More than 40% of the interviewed customers have existing group medical insurance from their employer. They purchase additional products from us to “top-up” their protection.

“Topping-up” your protection is important, because often our customers find their employers’ provided medical benefits inadequate. Among our customers, teachers, civil servants, and employees of small agencies face this challenge the most.

By buying a VHIS plan from us, customers can “top-up” their existing insurance plan. They may use it to cover deductibles from their group plans. Or save it for a rainy day, retirement, or an upcoming career move.

35% of the interviewed customers buy Bowtie products as their primary protection. Some of these customers are business owners, job seekers or freelancers, so they have no group medical plans at all. Facing more job uncertainty, they tend to choose the higher benefit limit and broader benefit coverage that we offer in our Flexi Plans. It becomes a no-brainer for them when they are facing an upcoming career change, or about to start a business.

The rest of the interviewed customers are buying for their families. Anticipating their parents’ declining health, customers want to be able to send them into private care. Bowtie makes it easy for customers to purchase medical insurance on behalf of their parents, without having to make special arrangements.

Our youngest insured customer at the time of writing this is 16 days old. In fact, children policies for kids aged 0 to 5 are the most popular among family related purchases.

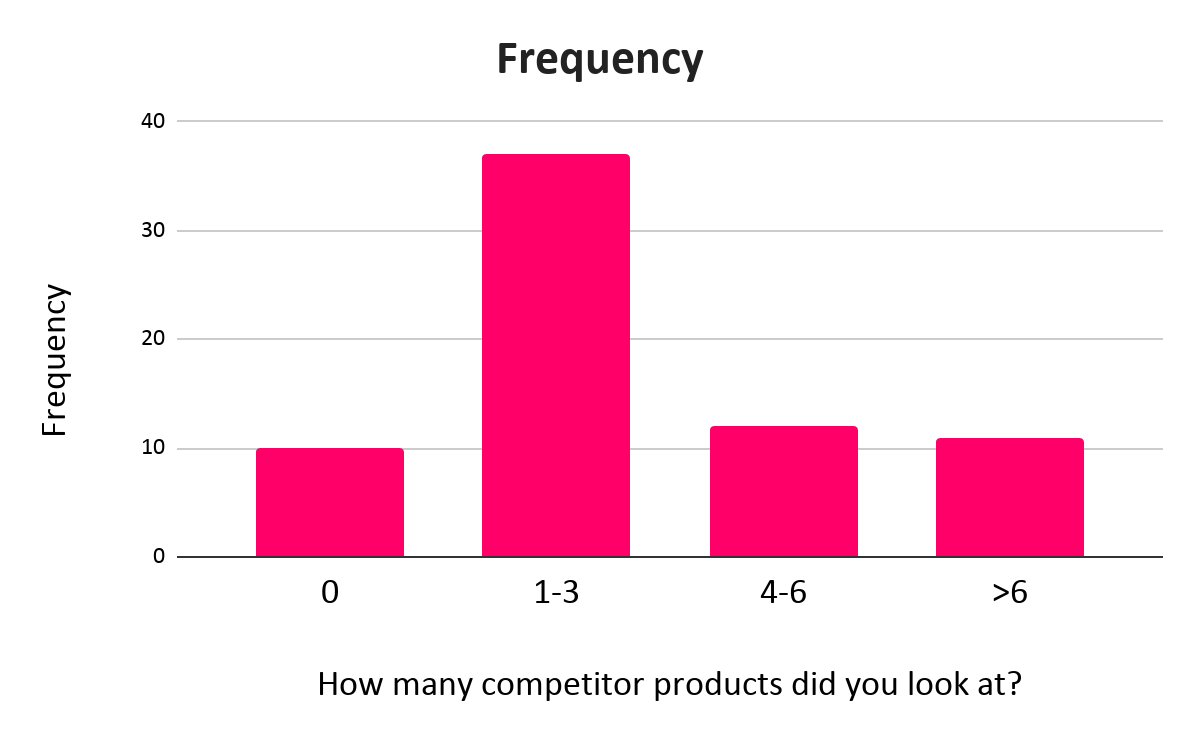

Did you shop around different providers?

Our customers are diligent. 90% of the interviewed customers did their homework by comparing us with other well-known insurance brands. Most of them rely on the many free online comparison tools like MoneyHero, MoneySmart and the government issued VHIS Plan Search Engine. A few read about us in the Consumer Council’s Choice Magazine.

Unlike most insurance products, VHIS benefits and terms are standardized by the Food and Health Bureau (FHB). This information gives customers unprecedented transparency into what they are paying for. For the first time, customers can easily compare the cost, brand and service quality of insurance providers, and make the best decision for themselves.

On average our customers compare 2.8 brands before making a purchase. Nearly one-third looked at more than 4 brands before making a purchase, including our largest competitors in life and medical insurance. Some are first-time buyers, while others are seasoned insurance product shoppers. We even attract insurance brokers who want to save on the agent commission – a key feature of Bowtie’s products.

Most people know they need protection, but few make it a priority until it’s too late. A big challenge that we face is accepting that sometimes we will have to wait for weeks, and even years, before a customer decides to complete a purchase.

The brave few who did not feel the need to compare before making a purchase, did so because they trusted the media that our premiums are the most competitive. They felt that we are affordable.

$147 per month for a 35-year-old male? Sounds fair to me.

Why did you choose a virtual insurer?

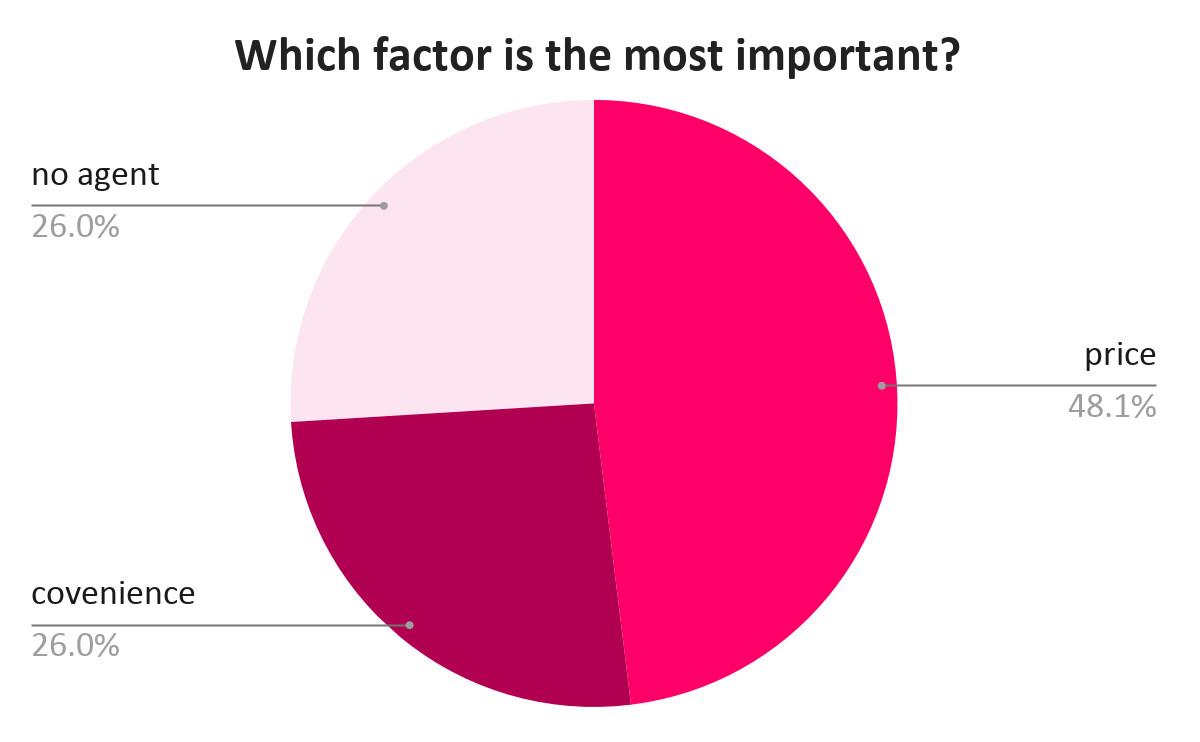

The interviewed customers are a price sensitive crowd. I spoke with customers who even remembered how many dollars our monthly premiums were cheaper than other comparable products. Half of them mention price as the motivation to pick a virtual insurer.

Bowtie has the lowest VHIS premiums for both men and women aged 0 – 75 years old. These cost savings add up quickly. Given the same standardized plan, our customers can end up saving as much as 260% in premiums.

I am incredibly proud of our team who has enabled this disruptive cost structure, so that we can pass on these savings to our customers.

A quarter of the interviewed customers chose us for convenience. Customers appreciate being able to get a price quotation instantly. More importantly, they know right away if they are eligible for coverage. Many of these customers are buying insurance in the evening, when they finally have time to catch up on personal time. That’s how convenient Bowtie is.

One-third of the interviewed customers appreciate our self-serve, agent-free purchase experience. They want to be in control of their buying decision, switching over from other providers because of unhappy experience with agents or unexpected changes to their premiums.

While customers obey social distancing rules due to COVID-19, a digital insurer is another safe way to get insurance that our customers can rely on. We also respect the privacy of potential customers who are only seeking information, sharing with them as many details as possible, and only asking for personal information when creating a binding offer.

In one case, a customer shared that her elderly mother had for years refused to buy any medical insurance because of the medical check-ups needed to complete underwriting. Our online-only underwriting questions helped the customer purchase medical insurance without having to visit a medical centre.

Why do you trust us?

Many of our interviewed customers took the time to dig into our company’s history. They were curious about how my co-founder and I started a company in an industry with so many entrenched players. It does read a little bit like David versus Goliath.

When they realized that John Tsang shares and supports our mission, our customers were positively surprised. John is working with us as a senior advisor due to our youth and energy, social purpose and disruptive technology. We’re proud that our customers agree with John.

We’re also proud to be working closely with our biggest backer – Sun Life. By leveraging their history and expertise, we successfully became the first virtual insurer approved by the Hong Kong Insurance Authority.

We’re also proud to be working closely with our biggest backer – Sun Life. By leveraging their history and expertise, we successfully became the first virtual insurer approved by the Hong Kong Insurance Authority.

Over time, we will continue to build trust with customer engagement and reviews. Many customers cite brand transparency and referrals as important motivators. Basic information about premiums and fees are still unavailable from many companies, and we want to change that.

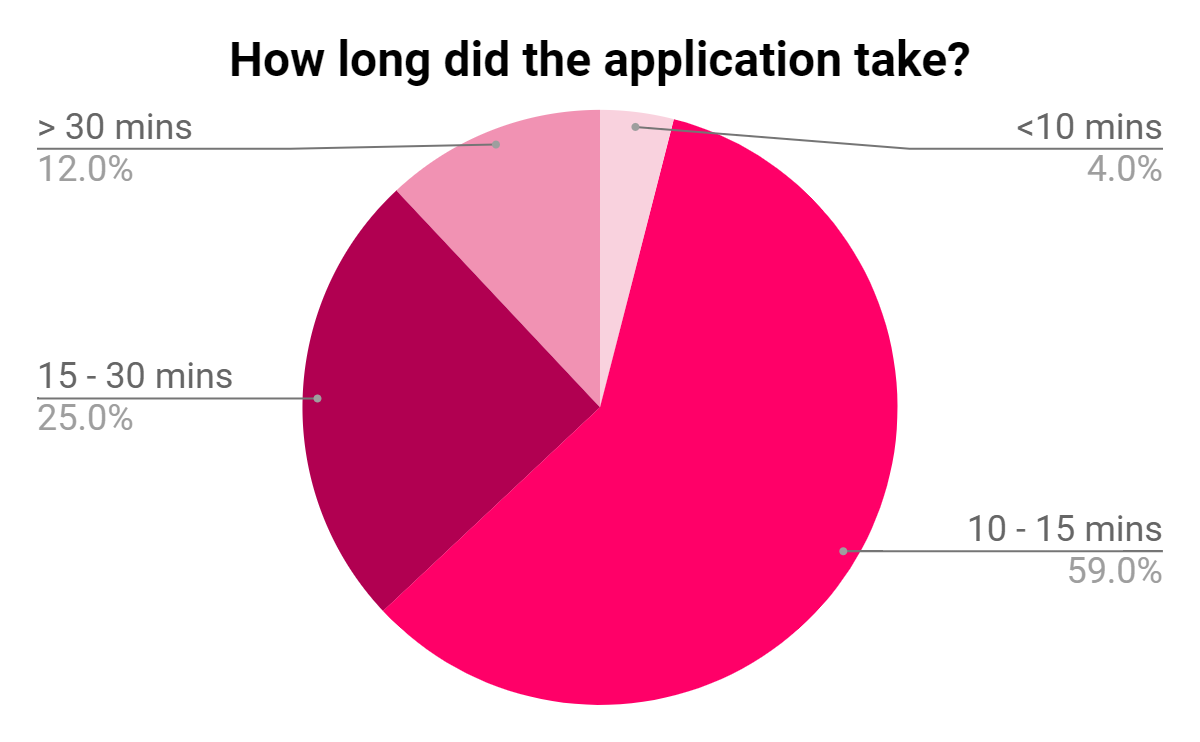

How was your purchase experience?

Our biggest breakthrough has been dramatically reducing the time it takes to submit an application for underwriting. Nearly half of our customers completed applications in one take, doing so in between 10 – 15 minutes. That’s an amazing accomplishment compared to conventional channels.

We invested significant effort in building an experience that’s simple and intuitive. We hid the complexity from our customers, while helping them move through the process confidently. This has resulted in more than 85% satisfaction with the application process.

For our customers who took longer to complete their application, we still have much work to do. Our software team will continue to make our platform easier to use on any device, while being more resilient to unexpected user behaviours.

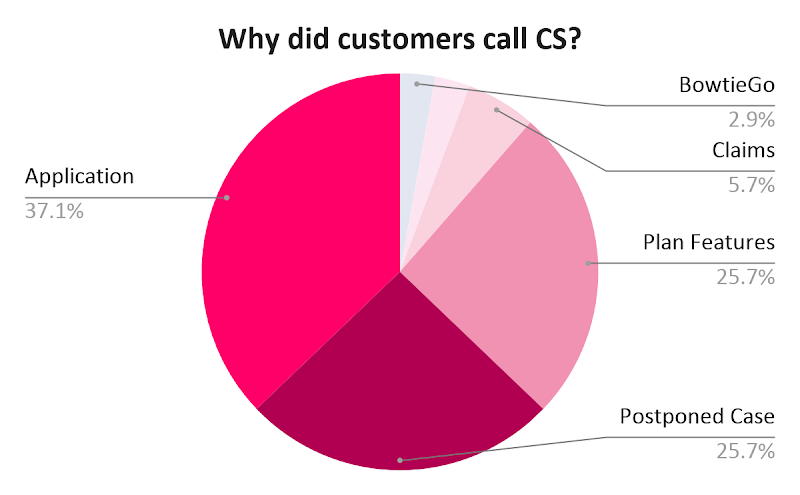

Did you reach out to customer support?

Although we have a dedicated team of healthcare and customer service professionals ready to help, we haven’t done enough to alert users to their existence.

We are proud of the fact that 60% of customers completed their applications without any human support. However, it’s equally important to us to be there to help when our customers need us.

40% of the interviewed customers contacted customer support. Some had genuine questions about our products, plans and features, and the application process. Other were curious to see whether we have a well-trained customer support team that’s responsive. We are glad to have exceeded our customer’s expectations.

Our customers are able to access their personal dashboard from their smartphone, find up-to-date plan and coverage details. This has the benefit of freeing up our customer support team from routine requests, allowing them to take care of trickier questions on plan features, underwriting problems, and claims.

This has resulted in positive and personal customers, where many customers recall the names of their customer service representatives.

How can Bowtie do a better job?

Many of the interviewed customers want more products. They are interested in products like critical illness coverage, cancer protection, and life insurance coverage. We’ve taken this feedback close to heart, and recently launched our cancer product and an outpatient service that improves the experience of going to the doctor. Life insurance and critical illness coverage are on the way.

Some customers mentioned that our pricing isn’t competitive enough for ages 0 – 5 or over 65. Others are concerned about whether a new company like our’s will be around in the long term. Several customers want to see us build a mobile app. A few think we need to get better at handling postponed cases for applicants who need to submit more medical history information.

Some customers found and logged bugs. Others gave us suggestions for product features that we’ve taken to our product team. One of our latest features that came from our customers is the “save and resume” feature for customers who can’t finish an application in one go, and need to come back later to resume it.

To deliver a delightful user experience, we will continue our weekly platform updates and feature releases. This will support our ever growing catalog of insurance products.

To deliver a delightful user experience, we will continue our weekly platform updates and feature releases. This will support our ever growing catalog of insurance products.

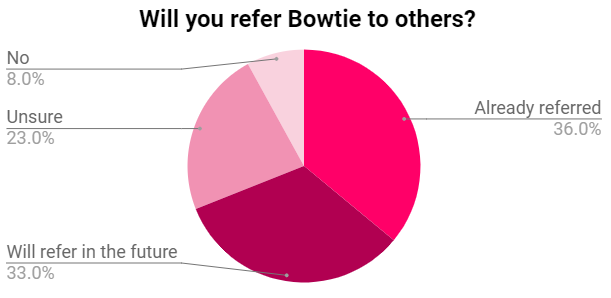

Have you referred your friends to Bowtie?

36% of the interviewed customers have already referred us to family, friends or colleagues. 33% of them plan to recommend Bowtie if asked.

We’re excited by stories of young parents trusting us with their whole family’s insurance. In one case, one of them bought 10 policies for the whole family.

Other customers want to wait and see how we handle their claims when the time comes. If they are satisfied with the claims experience, they would be more comfortable in referring their friends to us.

Most if not all want some kind of referral incentive. We will continue to improve our BowtieCash rewards program, and invest in providing discounts on other healthcare services like body checkups.

What did we learn from our first year?

The 1,500 minutes I spent on the phone with our customers rewarded me with surprising insights about our customers. Some share our values and philosophy, while others just think we’re a fun take at a traditionally serious topic. I’ve tried my best to keep it casual and fun, asking for feedback directly and openly, so nothing is lost in communication.

The people who picked up my calls come from all walks of life. Primary school teachers, bankers, entrepreneurs, NGO workers, undergraduate students, software engineers, nurses, former insurance agents, job seekers, housewives and more. Some of my calls have led to job interviews, business partnerships, and even friendships.

I’m humbled by everyone’s patience and honesty. I’m inspired to do more for Hong Kong, and to lead Bowtie in our pursuit of our mission. We can be Hong Kong’s best virtual insurer, and at the same time have the human touch that our customers trust.

Fred

The above information is for reference only. In no event shall Bowtie be liable to you or to any other party for any loss or damage whatsoever or howsoever caused directly or indirectly in connection with your access to or use of the content thereon.