Established in 1946, Anglo Chinese Florist is a renowned flower boutique in the bustling Flower Market Street (擺花街) in Central. With a focus on creating unique, customised floral gifts, they create exquisite floral arrangements, integrate fresh flowers and plants into homes, and offer event decoration services.

Anglo Chinese Florist has been in the retail industry for over half a century and like many of its counterparts, they experience frequent workforce changes. They wished for more efficient management tools to speed up administrative processes – and that’s why they chose Bowtie, for our easy activation process and transparent pricings. Now let us hear what they love about Bowtie Group Medical.

【Customer stories – Anglo Chinese Florist】4 Reasons why a flower boutique loves Bowtie?

- 【Bowtie Group Medical – 91APP】4 Reasons why an SAAS company loves Bowtie?

- 【Bowtie Group Medical – GreenPrice】4 Reasons why a social enterprise loves Bowtie?

- 【Bowtie Group Medical – Divit】3 Reasons why a Fintech company loves Bowtie?

- [Bowtie Group Medical – Bistrochat] 3 Reasons why a F&B startup loves Bowtie?

1. Fast activation of Group Medical coverage

Before Bowtie, whether it was activating employee medical insurance or handling departures, the process involved massive paperwork and manpower. Anglo Chinese Florist was accustomed to spending excessive time on paper-based applications.

Everything has become simpler with Bowtie. All they need to do is log into the online portal and instantly add or remove employees as fast as 5 minutes*, this significantly enhances overall work efficiency.

*5 minutes refers to the process of adding new employees and activating their group medical insurance protection through the digital platform, upon the corresponding group medical plan becomes effective.

2. Clear and transparent insurance plans

Through Bowtie’s website, Anglo Chinese Florist can easily access an overview of their health insurance plans. Their HR staff and employees can effortlessly review the covered amounts and details on Bowtie’s Group Medical Insurance webpage. Most importantly, there’re no hidden fees in the insurance plans. This allows easy budget management as the cost can be easily calculated based on the chosen plan and the number of covered employees.

3. Speedy and transparent claims process

Before using Bowtie’s Group Medical Insurance, their employees had to submit claims with physical forms and the process unnecessarily took up their time for other important duties.

After switching to Bowtie, the claim process has moved entirely online, making it simple, direct, and efficient. Also, employees can track their claim status through their own accounts so they can better manage their own claim payments and be notified as soon as the claims are paid.

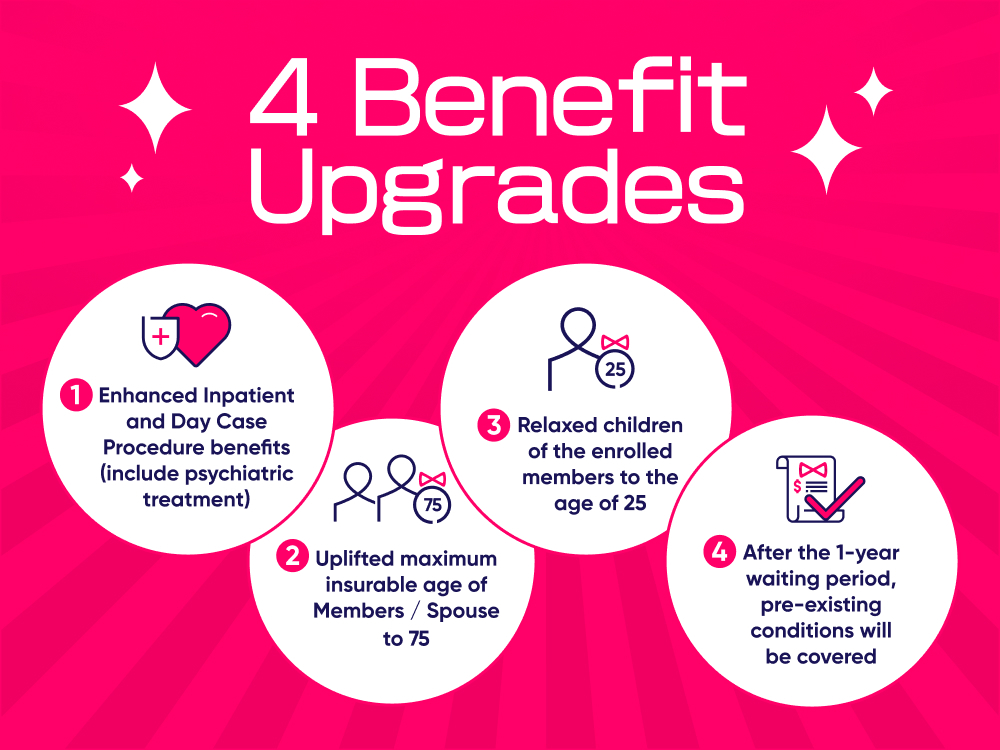

4. Upgraded group medical plans for extra protection

Opting for Bowtie’s Group Medical insurance not only reduced the administrative work but also made it more convenient for employees to understand the benefits they are entitled to. The team at Anglo Chinese Florist is highly satisfied with the upgraded service because Bowtie’s medical insurance offers extensive coverage which includes the most used outpatient benefit and traditional Chinese medicine benefits. The outpatient aspect comes in particularly handy when many of their employees already have personal inpatient coverage for more severe conditions.

Check out this series of walkthrough videos from Bowtie as you navigate through our online portal step-by-step!

How to create an employer account?

How to upload documents and submit an application on the employer account?

How to add or terminate members?

- The information displayed is for reference only and does not constitute nor is it intended to be construed as providing any offer, solicitation, or recommendation to purchase any insurance products.

- Please refer to the policy provisions and relevant pages for the detailed terms and conditions. Customers should purchase a plan according to their company’s needs or actual conditions.