As a local SME, we Bowtie have experienced a lot of turmoil within two years and have also learned firsthand the importance of cost control and talent acquisition.

In 2020, Bowtie already launched Group Insurance Basic Level (Basic) plans for SMEs, with premiums as low as HK$10 per person per month and covering the medical expenses of the spouses, children, and even parents of employees. We help many startups to improve their benefits system for employees. In June 2021, we have decided to launch Group Insurance Pro Level (Pro), a series of higher-end insurance plans, which focuses on enhancing the coverage for outpatient and dental treatments that concern many companies. These plans allow the employees to visit the clinic of their own choice without any medical network restrictions.

Great value for money for startups and SMEs

Bowtie was once contacted by a startup owner and found that he was particularly interested in the details of insurance plans and claims. Upon further questioning, we learned that he is the sole founder of the company. Due to limited manpower, he has to take on multiple roles: handling administrative tasks such as personnel, payroll, benefits including insurance plans and claim procedures. Thus, he was curious if we can offer a suitable plan for his relatively young team with less need for inpatient and day case procedures.

There are 2 levels of Bowtie Group Insurance plans, with 6 plans in total. The differences are shown in the tables below.

| Plan | Pro Bronze | Pro Silver | Pro Gold | Pro Platinum |

| Premium* | $388 | $488 | $598 | $798 |

| Life Insurance coverage | $25,000 | $50,000 | $80,000 | $120,000 |

| Inpatient and day case procedures (Reimbursement of 80% of medical expenses) | $25,000/year | $50,000/year | $80,000/year | $120,000/year |

| General practitioner | $420/visit** | $420/visit** | $420/visit** | $420/visit** |

| Chinese medicine practitioner | $270/visit** | $270/visit** | $270/visit** | $270/visit** |

| Dental treatment | $500/visit** | $500/visit** | $500/visit** | $500/visit** |

| Specialist | $690/visit** | $690/visit** | $690/visit** | $690/visit** |

| Physiotherapist (as referred in writing by a Registered Medical Practitioner) | Up to 50% off (Applicable to BowtieGo Medical Network) | $600/visit** | ||

| Chiropractor (as referred in writing by a Registered Medical Practitioner) | $600/visit** | |||

| Diagnostic imaging and laboratory tests (as referred in writing by a Registered Medical Practitioner) | $500/year | $500/year | $1,500/year | $2,500/year |

| Body check | Full coverage*** | Full coverage*** | Full coverage*** | Full coverage*** |

| Flu vaccine | Full coverage*** | Full coverage*** | Full coverage*** | Full coverage*** |

| Eligibility**** | Employee, spouse, children | Employee, spouse, children | Employee, spouse, children | Employee, spouse, children |

| Plan | Basic Bronze | Basic Silver | Basic Gold |

| Premium* | $10 | $98 | $198 |

| Life insurance coverage | $3,000 | $25,000 | $50,000 |

| Inpatient and day case procedures (Reimbursement of 80% of medical expenses) | X | $25,000/year | $50,000/year |

| General practitioner | Up to 50% off (Applicable to BowtieGo Medical Network) | ||

| Chinese medicine practitioner | |||

| Dental treatment | |||

| Specialist | |||

| Physiotherapist (as referred in writing by a Registered Medical Practitioner) | |||

| Chiropractor (as referred in writing by a Registered Medical Practitioner) | |||

| Diagnostic imaging and laboratory tests (as referred in writing by a Registered Medical Practitioner) | X | X | X |

| Body check | X | Full coverage*** | Full coverage*** |

| Flu vaccine | X | Full coverage*** | Full coverage*** |

| Eligibility**** | Employee, spouse, parents, children | Employee, spouse, children | Employee, spouse, children |

- *Monthly calculation per person

- **Up to 30 outpatient/dental visits per policy year. Up to 1 visit per day; the maximum benefit amount per visit/$30 deductible per visit.

- ***Once per policy year

- ****Age restrictions apply in certain plans

Regarding his situation, we recommended our Pro Silver plan. The premium for this plan is within his budget and insured employees can enjoy coverage for different treatments including outpatient treatments, Chinese medicine, specialists, dental treatments, physiotherapy, as well as an annual health check-up. Moreover, the annual HK$50,000 coverage amount for inpatient and day case procedures is sufficient to cover most expenses for intermediate surgeries such as hemorrhoidectomy and mastectomy. These protections can fulfil the needs of this company.

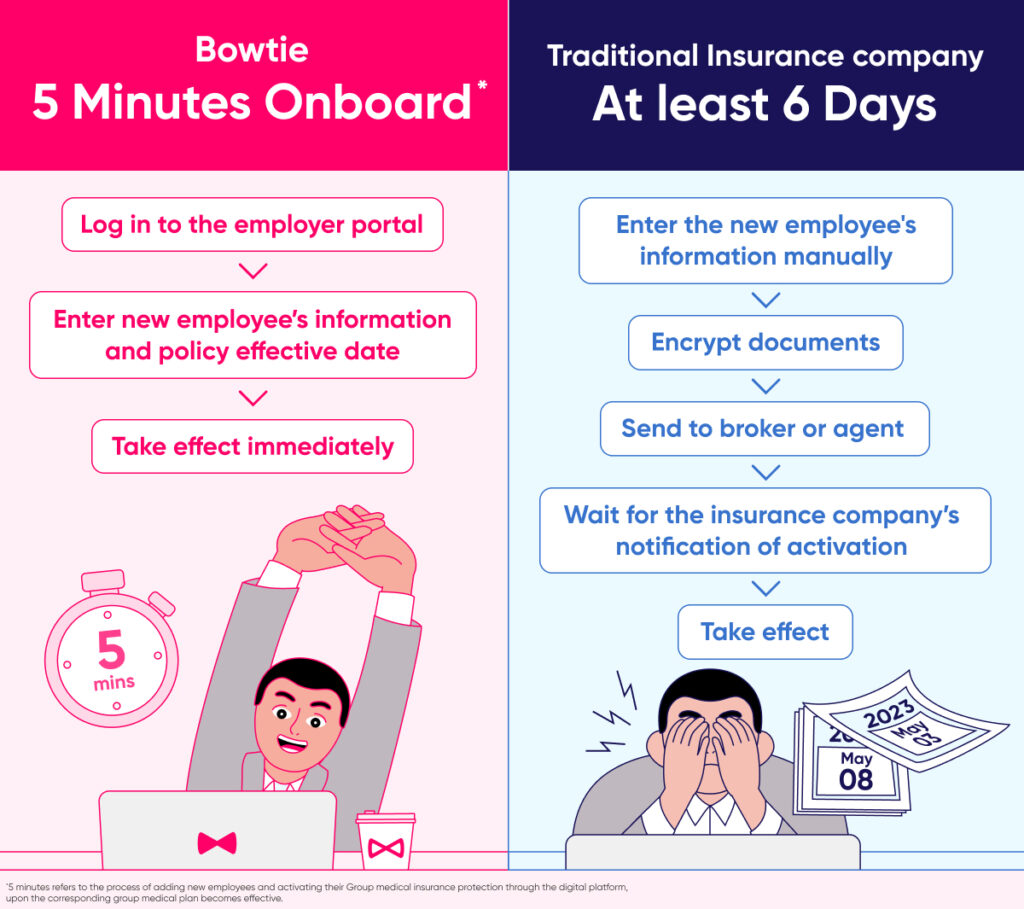

Best of all, Bowtie Group Insurance’s application and claims procedures can all be completed online. Even with no intermediaries involved in the entire process, employees can submit claims and track their approval progress on their own through our all-in-one platform. Ultimately, we wish to save precious resources and time for you and your company.

With no underwriting process and an easy application process, this owner has managed to get his employees cost-effective medical coverage at an ideal price within only a few days. If a startup owner chooses a Pro Bronze plan, he will have the option to switch to a better plan with more comprehensive coverage, such as Pro Silver or Pro Gold, in the next policy year, as the business grows. His employees, on the other hand, will enjoy flexible coverage for inpatient and day case procedures, as well as chiropractic treatments, physiotherapy, diagnostic imaging and laboratory tests, and more.

Comprehensive coverage for all

To meet the different needs of the employees, Bowtie Group Insurance plans cover a range of treatments including outpatient treatments, dental treatments, surgeries, body check, and flu vaccines. You may refer to the following cases for reference.

Mr. C is a company owner and his company is covered by the Pro Silver plan. Last year, he unfortunately developed rectal bleeding and was diagnosed with hemorrhoids, which required surgical removal. Classified as an intermediate surgery, the cost of a hemorrhoid removal surgery ranges from HK$26,428 to HK$50,375 in private hospitals and from HK$19,350 to HK$30,450 in public hospitals. Mr. C finally chose to go to a private hospital for treatment and was hospitalised for 1 day after the surgery. He was charged a total of HK$50,4461, including miscellaneous expenses on the day he was discharged.

Under the terms of the Pro Silver plan, Bowtie can pay up to 80% of eligible medical expenses, which means that the resulting deductible for this case was only about HK$10,000.

After being discharged from the hospital, Mr. C submitted a claim by uploading the documents to Bowtie’s online platform on his mobile phone. With all the necessary info provided on time, his claim was approved on the same day. The payment was processed within 2 working days.

Mr. M is a sales manager of a company using the Pro Silver plan. He is a hiking enthusiast and was on one of his hiking excursions on a Sunday. He’s developed knee pain after his hike. His first thought it was only just a sprain and tried to treat himself with a pain-relieving rub. The next day, however, the pain grew stronger and he decided to seek medical advice. The doctor confirmed after an MRI scan that the meniscus was torn and a surgery was necessary. Mr. M was hospitalised for 2 days and the total cost of the surgery and hospitalisation amounted to HK$61,1472.

Under the terms of the Pro Silver plan, Bowtie can pay up to 80% of eligible medical expenses with a limit of HK$50,000 per year. As a result, the deductible for the total surgical and hospitalization expenses of approximately HK$60,000 turned out to be only HK$12,230.

The attending doctor advised that he receive physiotherapy after discharging from the hospital. The physiotherapist concluded that it would take at least two months or more for him to fully recover and thus recommended the patient to receive regular physiotherapy and rehabilitation training.

Since physiotherapy is also covered under the Pro Silver plan, this manager is free to choose the physiotherapist of his choice for treatment up to HK$600 per visit (HK$30 deductible). In the end, he chose a physiotherapist recommended by a friend and eventually paid only HK$30 deductible for each treatment session of HK$460, which means a savings of over 90%.

As a project specialist, Ms. W has had a busy life style and had suffered from persistent stomach aches for 6 months. After visiting a general practitioner, he was referred to a specialist for gastroscopy. Upper abdominal pain is one of the common symptoms of stomach cancer. The doctors usually suggest patients undergo a gastroscopy for further examination if such symptoms occur. For minor surgeries like gastroscopy, private hospitals in Hong Kong charge from HK$4,300 to HK$8,300 and the patient opted for the HK$8,300 package in the end. Covered by Bowtie’s Pro Silver plan, 80% of the cost was covered, paying over HK$6,600 for him.

Moreover, under the Basic Silver plan, the insured can use the member-exclusive price of BowtieGo medical network to pay for consultation. The patient can get access to the consultations of family doctors and specialists at up to half the cost. From the first consultation to the gastroscopy, Bowtie provides excellent coverage at every step of the journey.

The marketing specialist of a company protected by the Pro Bronze plan went to a dental clinic for scaling. Since most company health insurance policies do not cover dental care expenses, one usually needs to purchase additional coverage if one wants to have a dental checkup or cleaning. In this regard, the coverage of Bowtie is way more comprehensive. Under all Pro plans, all dental checkups, cleanings, and other dental treatments are also covered, with only a deductible of HK$30 for a visit up to HK$500.

The cost of a dental scaling in the market ranges from HK$400 to HK$1,000, but this marketing specialist ended up paying a HK$30 deductible, which is a savings of over 90% compared to the HK$400 commonly paid in the market.

This marketing specialist is also very dedicated to his health and regularly consults a Chinese medicine practitioner for health care. Under Pro Bronze, the benefit amount for each Chinese medicine visit is HK$270 (HK$30 deductible). The consultation fee of the Chinese medicine practitioner whom he knows well, together with costs for prescribed Chinese medicines for two days, is exactly HK$270. So he has to only pay HK$30 deductible for each visit. With a limit of 30 visits for clinic consultation and dental treatment per year, the 2 visits to the Chinese medicine practitioner per month are well covered.

If you are interested in applying for Bowtie Group Insurance for SMEs and start-ups, please visit our Bowtie page to drop us a line and leave us your contact details, or contact us by email at cs@bowtie.com.hk. You can also call us at 3008 8123 or contact us via WhatsApp for more information instantly.

- 1Median of charge for hemorrhoidectomy at Hong Kong Sanatorium & Hospital according to statistics in 2020.

- 2Median of charge for knee arthroscopy at St Teresa's Hospital according to statistics in 2020.