Founded in 2013 in Taiwan, 91APP is a leading omnichannel commerce solution provider, Taiwan’s first listed Saas tech company, providing brand-owned shopping Apps and websites for retailers. In 2019, recognizing the growing HK online shopping sector, 91APP branched out to Hong Kong.

Due to the rapid expansion of 91App business in Hong Kong, the company has grown from just a few colleagues to a team of 30-40 within a short period. There are a few common issues they will encounter, including the extensive daily paperwork and review processes from the HR department. However, as 91APP’s main business focuses on e-commerce development and they want to focus on their core operations, the company hopes to streamline HR tasks in a digital way. 91APP appreciates Bowtie’s automated online platform and the clear Group Medical Insurance plans, which can save them more time in sourcing employee benefits.

【Bowtie Group Medical – 91APP】4 Reasons why an SAAS company loves Bowtie?

1. Streamlined application process on a user-friendly portal

When searching for Group Medical insurance, 91APP easily accessed Bowtie’s website to understand the plans and promptly connected with the dedicated teams for additional insights. The entire application procedure was speedy and straightforward. In addition, 91APP can buy different insurance plans for employees based on needs. Managing new hires and departures is a breeze for HRs through the intuitive portal.

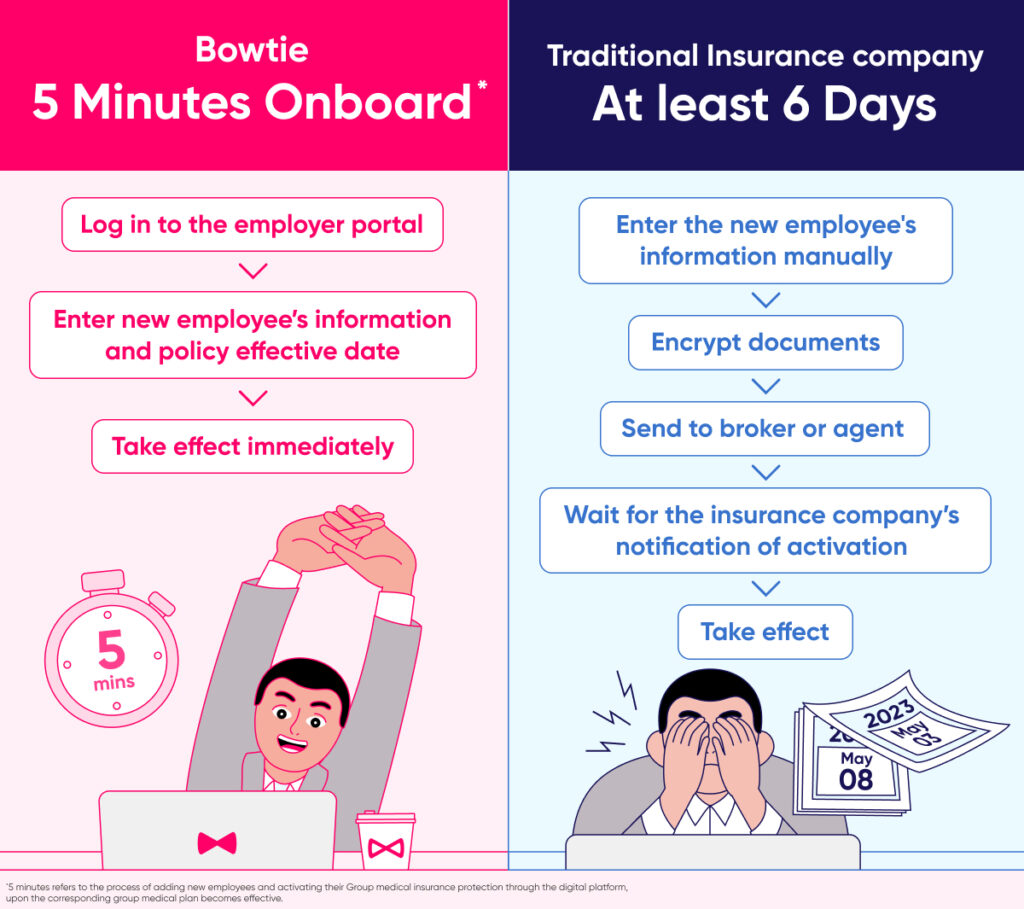

2. Improved HR Administrative efficiency

From a managerial perspective, HR greatly benefits from Bowtie Group Medical. Prior to Bowtie, processing employee benefits and health insurance required complicated paperwork and manpower, incurring higher administrative costs. Bowtie helps to streamline the management – simply logging in to the portal to add or remove insured members and modify insurance plans. This not only saves time and costs in handling employee benefits but also enhances work efficiency, allowing more resources for other business development.

3. Claim submission in 2 minutes

During the claims process, employees are able to upload supporting documents and answer a few simple questions in under 2 minutes. Claim request’s approvals were swift with within days. Additionally, employees can monitor their claims via the Bowtie employee’s account and then receive email notifications upon successful fund transfers. In case of any doubts, employees can reach out to Bowtie’s dedicated customer service team and this greatly eliminates the need to inquire with HR.

4. Enhanced claim experience with more privacy

Each insured employee has a dedicated claim account to ensure more privacy. There are instances when employees refrain from disclosing reasons during the claim process or avoid consulting HR about insurance terms and eligible illness claims. Bowtie’s online portal effectively minimizes such potentially uncomfortable circumstances.

To assist employers or HR in achieving their goals, Bowtie has recorded multiple videos to provide step-by-step guidance and easy issue resolution.

How to create an employer account?

How to upload documents and submit an application on the employer account?

How to add or terminate members?

- The information displayed is for reference only and does not constitute nor is it intended to be construed as providing any offer, solicitation, or recommendation to purchase any insurance products.

- Please refer to the policy provisions and relevant pages for the detailed terms and conditions. Customers should purchase a plan according to their company’s needs or actual conditions.