Taking care of yourself and your loved ones should feel like a breeze.

Bowtie is Hong Kong’s first virtual insurer. Our team’s main goal is to make insurance simple and friendly. We believe our customers deserve to find the protection they need quickly. They deserve to purchase the right insurance product easily without breaking the bank. And they should be able to get help easily when facing life’s challenges.

In just 15 minutes, on their smartphone, customers can complete their underwriting process. This is a process that normally takes days! In fact, the user experience is now so seamless that most customers never have to speak to us before buying insurance.

As we continue to grow and launch new products, we want to hear more of our customer’s feedback.

Like most technology companies, our marketing and data teams have worked hard to understand where customers come from, and whether they are having a smooth experience while using Bowtie. But data only goes so far.

We had to put a face to the numbers. Instead of waiting for them to contact us, we decided to reach out to them.

Our co-founder and co-CEO, Fred Ngan volunteered to make the phone calls. We emailed a random list of customers with an invitation to speak for 20 minutes. And then we waited.

To our surprise, more than a few customers agreed to speak with me. Several customers were surprised to be invited to speak with an insurance company CEO. Others were just happy to help.

We started out thinking we’d do a few calls. We’ve done more than 100 now. Every Wednesday, no matter what I have scheduled.

Here’s what we’ve learnt.

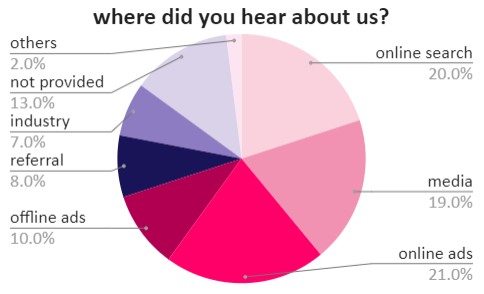

How did you hear about Bowtie Insurance?

A significant share of our customers heard of us on the news (19%), and found us via Google search (20%). Our first product launch was around the time the Hong Kong SAR government officially unveiled the Volunteer Health Insurance Scheme (VHIS). This garnered significant coverage from local and international media.

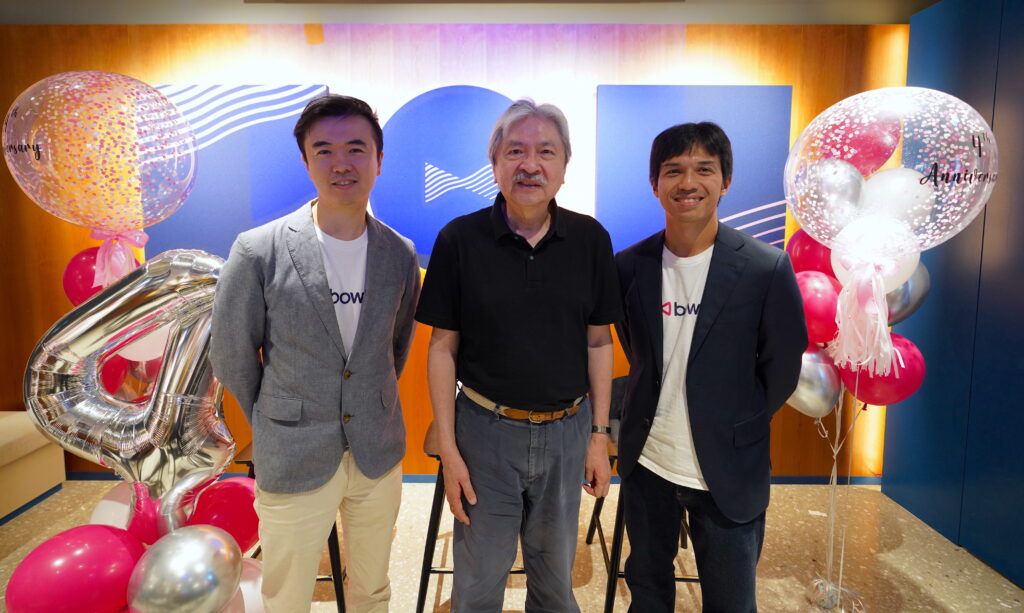

Collaborating with one of our most recognizable supporters – Mr. John Tsang, we launched a series of offline brand campaigns. Our customers remember seeing our pink bow-ties, face masks and hand sanitizers in the street.

Combined with digital ads, customers slowly started to recognize our brand in different channels. When Googling for information related to protection, diseases and health insurance, we became their trusted source of truth.

We also meet many of our customers through partner referrals, and industry conferences. The two largest industries represented are finance and technology.

Have you bought insurance before?

More than half of the interviewed customers were first-time buyers of insurance. This speaks to Bowtie’s ease-of-use. With little to no experience buying medical insurance, customers were still able to complete the online application process.

Of the customers who had purchased insurance before, one-third are buying Bowtie products for their dependents. These may be their parents, spouses, children and siblings. Having worked with insurance agents before, they now have the confidence to pick the right policies for their loved ones.

Getting medical insurance is usually a long and winding process. You may have to declare your medical history, complete several forms, provide personal documents and more.

Bowtie simplifies this process dramatically. It speaks volumes when first-time insurance buyers are able to buy medical insurance on their smartphones without needing any help.