Whole Life Insurance

What is Whole Life Insurance?

Whole life insurance provides both life insurance coverage and returns. A portion of the premium goes towards investment. Insured can cash back at any time or save the profit in the policy for the accumulated profit. In addition, the insured/ beneficiaries could claim in a lump sum until the insured dies/ termination of policy/ after the coverage period (assuming the insured turns 100).

The premium payment period of whole life insurance varies in different plans. It could be from 10 years to 30 years, or even longer. The premium is fixed during the payment period. After that, the insurers do not need to pay an extra premium. And, the plan would stay effective to provide lifelong insurance protection and long-term potential investment revenue to the insured.

How does Whole Life Insurance work?

Most people consider whole life insurance an investment tool, mainly because the policy would provide death compensation to the beneficiaries and constantly accumulate cash value.

Whole life insurance would assign a portion of the premium to different investment projects. The profit would generate a more significant return by time and compound interest effect. Therefore cash value will grow sustainably, similar to the principle of long-term investment.

The cash value calculation could be complicated, depending on the actuary’s calculation and insurance companies’ investment portfolio. But, simply speaking, after deducting commission, guaranteed cost and operating expenses of premium payment in each period, and adding return interest generated by the insurance company investing in the remaining premium, the Insured can withdraw the final dividends at any time.

The calculation of “Cash Value” is relatively complex, involving actuarial calculations and the impact of the insurance company’s investment portfolio. Simply put, it deducts commissions, protection costs, and operating expenses from each premium paid, and the remaining premium generates returns through the insurance company’s investments. The policyholder can withdraw dividends at any time.

The premium of Whole Life Insurance

Different to term life insurance, whole life insurance has a fixed payment period. During the period, the premium would not change once it is determined.

Since whole life insurance has a fixed premium within several decades, the premium is higher than term life insurance. Assuming that the insured is a 35-year-old male non-smoker, below is his premium comparing term life insurance and whole life insurance.

| Death Benefit | Average yearly premium | |

| Bowtie Term Life Insurance (renew yearly) | 2 million | Around HK$1,280 |

| Term Life Insurance (10 years coverage period) | 2 million | Around HK$2,540 |

| Whole Life Insurance (10 years payment period) | 2 million | Around HK$69,000 |

Pros and cons of Whole Life Insurance

Pros

The attractiveness of whole life insurance:

- The premium would remain unchanged during the payment period. As a result, the insured does not need to worry about any increase in premiums or additional costs due to getting older or worsening health conditions.

- In addition, whole life insurance has an investment portion. The insurance company would invest for the insured, and the profit gained would turn into accumulated profit on a yearly basis. Therefore, buying whole life insurance seems to be a long-term investment strategy for most insureds.

Cons

- Once you have applied for whole life insurance, you need to keep contributing until the payment period ends. If you wish to terminate the policy earlier, you cannot get the guaranteed return or dividend if the surrender value is lower than the paid premium. It could cause a loss and lower the flexibility of capital movement.

- Besides, the premium is relatively high as whole life insurance involves both investment and coverage. The sum insured is relatively lower than term life insurance under the same premium. Therefore, it might not be the best option for those who are seeking more coverage.

Is Whole Life Insurance right for you?

If you have the following conditions, you can consider whole life insurance:

- You can afford a higher premium and would not terminate the contract before the payment period ends

- You would like to withdraw money irregularly from your insurance account

- You are not familiar with investment and looking for a stable return

- You are seeking a stable premium instead of a yearly increasing premium

However, if you are looking for a low cost and steady return, instead of whole life insurance, you can also consider investing in a low-risk investment product in a no-commission securities investment platform.

If I want to buy Life Insurance, are there other choices?

Term life insurance is a good option for those who want full coverage for their family.

Compared to whole life insurance, term life insurance offers an affordable premium as most of the premium is used for coverage purposes. Therefore, with the same premium, the insured can get higher coverage.

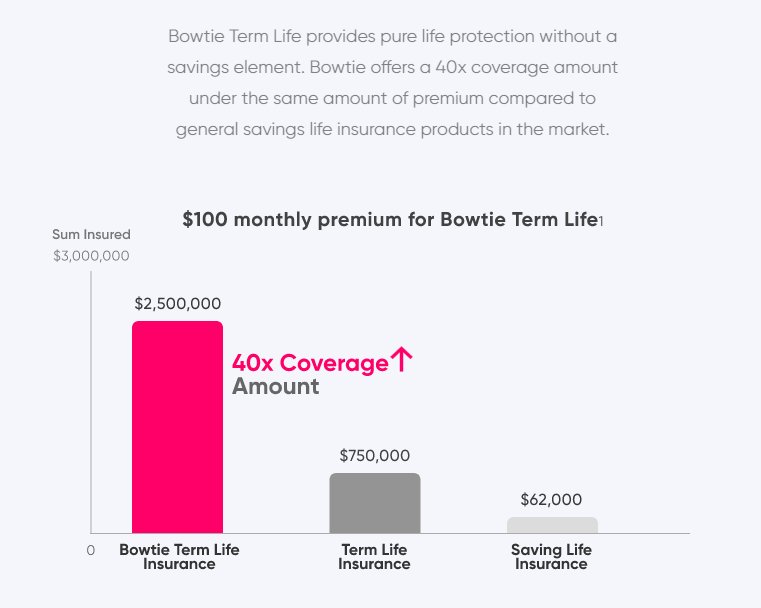

According to the survey, under the same amount of premium,

- Term life insurance offers 12x sum insured^ compared to whole life insurance

- Bowtie offers a 40x sum insured compared to general endowment plan products in the market.

- ^Sample rates are for a policy with HK$1 million coverage for a 35-year-old female non-smoker.

- Term life: the average standard premium for term life insurance (20-year term) on the market (including online term life insurance and 8 other term life insurance plans), as of 1 July 2020.

- Endowment plan: the average premium for 8 endowment plan (20-year term) on the market, as of 1 July 2020.

- 1NerdWallet: Term Life vs. Whole Life Insurance: Differences and How To Choose

- 2Investopedia: Whole Life Insurance Definition: How It Works, With Examples

- 3Guardian Life: Whole Life Insurance

- 4Value Penguin: What is whole life insurance

- 5Business Insider: Who should have whole life insurance