The COVID-19 pandemic has taken a toll on the economic well-being of many Hong Kong people. Many have to cut their spending and reduced all non-essential expenditures. Bowtie’s client James (pseudonym) is no exception. During the pandemic, James underwent a series of upheavals. Faced with huge living expenses all of a sudden, he even had to go as far as cancelling his insurance policy. Let’s hear his story and find out how Bowtie took extraordinary measures to help James during these difficult times.

(The following case is an authentic account and for reference only.)

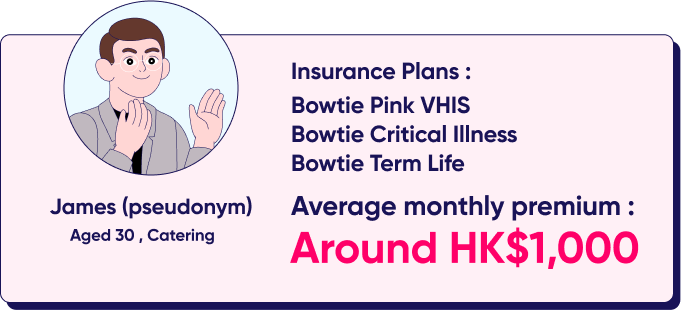

James (pseudonym) is 30 years old and works in the catering industry. He lives in a rental unit with two dogs. He purchased Bowtie Pink VHIS Plan, Bowtie Critical Illness, and Bowtie Term Life.

Caught off-guard

In February 2022, Kelvin of Bowtie’s User Experience team noticed that James had cancelled all three policies during a routine customer follow-up. Kelvin then decided to call James to find out why.

James said he had always supported Bowtie:

However, a series of disruptions in his life had forced him to cancel all his insurance policies. His income had dropped significantly in a short period of time, whereas unexpected expenses had piled up, turning his whole life upside down. Little by little, James told Kelvin about his circumstances:

1. The business of his working restaurant had plummeted

During the 5th wave of the pandemic, the government implemented a series of anti-epidemic measures, among which the ban on dine-in meals in the evening greatly affected the restaurant where James worked. Due to the sharp decline in the restaurant business, he was forced to shorten his working hours, cut his income by 30% and take unpaid leave, and his working hours also became unstable. Afterwards, the restaurant owner decided to renovate the restaurant during this quiet period, and thus, the business was suspended, leaving him without work and unemployed for 2 to 3 months.

2. Landlord suddenly asked him to move out

The landlord had suddenly declared bankruptcy, and James was informed to move out and find a new place to rent at short notice. He even got into a dispute with the landlord over the deposit, which he was unable to get back for a long time. In addition, properties for rent were relatively expensive, and many properties do not permit tenants to keep pets, making it extremely difficult for him to find suitable accommodations in a short period.

3. Pet needed surgery

Unfortunately, one of James’s dogs fell ill during this time and required immediate surgery. For this reason, he spent nearly HK$50,000 on medical expenses for his dog’s treatment.

Since James was struggling with three difficulties simultaneously, he had to save as much money as possible at that time. He had no choice but to cancel all his insurance policies in order to spare HK$1,000 a month. Clearly in distress, James choked out:

How did we help James?

Kelvin, on the other end of the line, felt very sympathetic and concerned. Although he could not change anything about James’s situation at that moment, he wanted to help in whatever way possible. Kelvin explained the risks of cancelling the policy to James in detail. James thanked him for the reminder and said he would re-apply the insurance plans to get covered once he overcame his difficulties.

After the call, Kelvin kept thinking: How can we help James?

Always eager to provide more help, Kelvin reported James’ case to the company to see if any support was available.

Insurance knowledge:

- In the unfortunate event that the customer suffers an accident after cancelling the policy, there will be no coverage.

- If the customer intends to re-apply after cancelling the policy, they will be required to undergo medical underwriting again.

- When the customer re-applies for the policy, the waiting period for unknown pre-existing conditions will be calculated from the new policy’s effective date. For example, Bowtie Pink VHIS Plan does not cover unknown pre-existing conditions that occur within 1 year from the policy’s effective date.

Extraordinary times called for extraordinary measures

After reporting James’ case to the company, Kelvin had an internal discussion with relevant colleagues, hoping to find ways of helping James. When the company’s management heard about this case, they believed that “extraordinary times call for extraordinary measures” and agreed to handle this case flexibly:

Bowtie believes that insurance should be “people-first.” Therefore, after some internal discussions, Bowtie decided to reactivate all policies for James without affecting the underwriting and waiting periods, also waived one year of premiums for his Bowtie Pink VHIS Plan.

The next day, Penny from the customer service team called James to inform him of the plan and explain the reasons for such arrangements. She also told James, “Next time, if anything comes up, give us a call first, and we will figure out how to help you!”

James was very moved when he learned that his insurance policy had been reinstated and the first year of premiums for Bowtie Pink VHIS Plan had been waived. He then thanked Kelvin and Bowtie profusely.

Postscript: Why did we make that decision?

Before coming to that decision, Bowtie had considered multiple factors, including:

- While James had indeed purchased multiple insurance policies to protect himself, one’s fortune can change in the blink of an eye, it was surely daunting for him to face all three complications at the same time. As a “people-first” insurance company, Bowtie believed that it was only appropriate to come to the aid of James by waiving the premiums of the medical insurance plan, given that the amount involved was not enough to jeopardize the principle of fairness between policyholders;

- In terms of underwriting, since James had only just cancelled the policy for a week, after the profession assessment by the Bowtie’s team, it was decided that James’ physical status would not have changed much in such a short space of time. Therefore the company decided to reinstate all of his policies without affecting the underwriting decision and waiting periods;

- The catering industry has borne the brunt of the pandemic, and the general consensus is that it will be difficult for the industry to recover from the pandemic any time soon. As a local enterprise, Bowtie hopes to stand by the people of Hong Kong during these difficult times to the best of our ability, and providing appropriate assistance when it is able is also one of the company’s corporate social responsibilities.

As a start-up company that has only been established for three years, we promise to keep our “people-first” service approach in mind and try our best to protect and help every customer. Bowtie hopes that Hong Kong society will take the pandemic in stride so that everyone, including James, can get back on track!

This is a special handling during such an extraordinary situation. Any request will be evaluated based on individual circumstances and may require a case-by-case assessment.