- Covering 4 types of early stage critical illness including carcinoma-in-situ and angioplasty surgeries ¹

- Offering 10 claims in total for both early stage critical illness and major critical illness combined, with a total payout of up to 600% of the coverage amount ² ⁴

[21 December, 2023 — HONG KONG] Bowtie, Hong Kong’s first virtual insurer³, is pleased to announce the launch of a new product, “Term Critical Illness – Early Stage & Multiple Cover” building upon its existing product, “Term Critical Illness – Multiple Cover”. By introducing a pure protection insurance product that covers early stage critical illness, Bowtie aims to continue providing customers with up-to-date and comprehensive protection, fixing the significant protection gap in Hong Kong.

The product features of Bowtie’s “Term Critical Illness – Early Stage & Multiple Cover” are as below:

- Covering 4 types of early stage critical illness including carcinoma-in-situ, early stage malignant and two types of medical conditions that require angioplasty surgeries¹

- Covering cancer recurrence, recurring heart attack and stroke⁴

- Covering 42 types of major critical illness and 98% of critical illness cases⁵

Due to its relatively comprehensive coverage in common critical illnesses, 10Life, the insurance ratings and comparison platform, has given high praise to Bowtie’s “Term Critical Illness – Early Stage & Multiple Cover”. Upon its launch, the product received an impressive rating of “9.8/10” in the category of term critical illness insurance, surpassing its competitors and becoming the highest-rated term critical illness insurance product on the 10Life platform. It was also honored with the “5-Star Term Critical Illness Insurance Award”, demonstrating its great competitiveness.

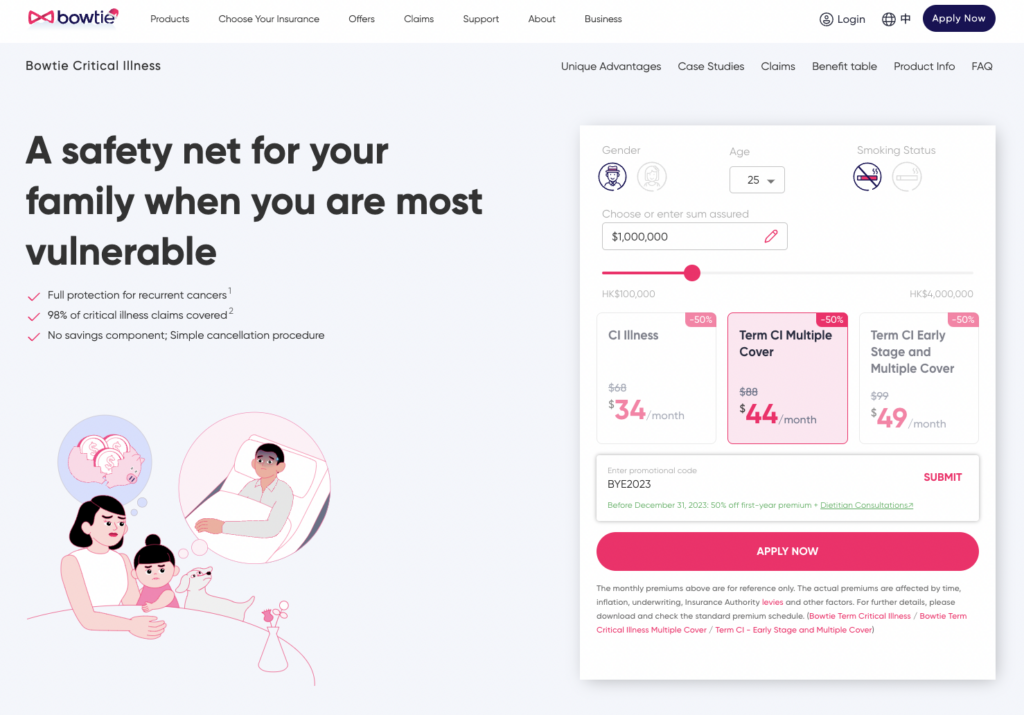

In addition, Bowtie’s “Term Critical Illness – Early Stage & Multiple Cover” offers significantly higher value-for-money compared to similar products. When comparing the average premiums for a 25-year-old non-smoking male with a coverage of HKD 1 million over 10 years (as shown in the table below), to the utmost extent, Bowtie’s product is priced at nearly 60% ⁶ lower than another product that also received the “5-Star Term Critical Illness Insurance Award”, while providing similar coverage to customers.

| Average Premium for HKD 1 million coverage over 10 years ⁷ (Male, Non-smoker, Annual Renewal) | ||||

| Age | Bowtie’s “Term Critical Illness – Early Stage & Multiple Cover” | Product A | Product B | Price difference |

| 25 | $1,649 | $4,061 | $2,934 | From -43.79% to -59.39% |

| 35 | $3,761 | $8,306 | $8,256 | From -54.44% to -54.71% |

| 45 | $9,970 | $14,463 | $19,011 | From -31.07% to -47.56% |

Early stage critical illness refers to diseases that have not yet progressed to a severe stage. Common examples include carcinoma-in-situ, early-stage malignant tumors, and medical conditions requiring angioplasty surgeries¹. According to data from the Hospital Authority, 2.8% of Hong Kong people will be diagnosed with cancer before the age of 45⁸. For example, among women aged 45 to 49, the incidence rate of breast carcinoma in situ is as high as 36.2 per 100,000 population⁹. In addition, between the years of 1998 and 2008, there was an almost 40%¹⁰ increase in middle-aged coronary heart disease patients aged 40 to 50. Although these signs indicate a trend of younger onset of critical illnesses, not every critical illness insurance product covers early stage critical illnesses. Therefore, Bowtie has introduced corresponding products to help customers manage their risks.

Typical critical illness products in the market generally provide an “advanced” payment of 20% of the sum assured as early critical illness benefit. If the insured person subsequently suffers from a severe critical illness, only the remaining 80% of the sum assured will be paid. However, Bowtie’s “Term Critical Illness – Early Stage & Multiple Cover” provides an additional payment of 20% of the sum assured as coverage for early critical illness. If the insured person develops a severe critical illness after the waiting period for early critical illness benefit, 100%¹¹ of the sum assured will be paid, therefore it will be providing a total coverage of 120% for the insured person.

To ensure that more customers can experience the peace of mind brought by “Term Critical Illness – Early Stage & Multiple Cover,” starting from now until December 31, 2023, new customers who successfully apply with the promotional code [BYE2023] will enjoy a waiver of 6 months’ premium and 4 complimentary consultations¹² with a nutritionist. Bowtie’s customer service team is also readily available to provide objective explanations and assist customers in making the most suitable decisions for themselves.

To learn more details, please visit: https://www.bowtie.com.hk/zh/insurance/critical-illness.

About Bowtie

The Bowtie Life Insurance Company Limited is an authorised life insurance company and Hong Kong’s first virtual insurer. Its vision is to bridge the health protection gap and transform the way people access healthcare in Asia. By combining modern technology and medical expertise, Bowtie offers a commission-free and convenient online platform for customers to quote, apply, and claim for health insurance plans anytime, anywhere. Bowtie is backed by Sun Life Financial, Mitsui & Co, and supported by leading international investors. Currently, Bowtie has raised more than HK$680 million and provided over HK$60 billion of insured value to families. Stay up to date at www.bowtie.com.hk.

Media Contact

Conrad Yeung (Bowtie)

Senior Corporate Communications Officer

- ¹ Angioplasty surgeries includes: (i) Angioplasty, Atherectomy or Minimally Invasive Direct Coronary Artery Bypass Grafting for coronary arteries, and (ii) Angioplasty or endarterectomy for carotid arteries

- ² Early Stage Critical iIllness Benefit provides a benefit equivalent to 20% of the Sum Insured and the maximum number of claims payable is 5 times, which is subject to a maximum of HKD300,000 per Insured Person of each claim. The maximum total benefit amount is equivalent to 100% of the Sum Insured or HK$1,500,000 (whichever is lower). This benefit is subject to an Early Stage Critical Illness Benefit Waiting Period and a maximum number of times you can claim for each early stage critical illness. This benefit will be automatically terminated after any MajorCritical Illness Benefit that has been paid or become payable, whichever is earlier. Please refer to the Policy Terms and Conditions and Exclusions for details

- ³Bowtie is the first company authorized by Hong Kong’s Insurance Authority under its Fast Track Pilot Scheme

- ⁴For claims related to the Multiple Critical Illness Benefit, additional requirements must be fulfilled for cancer (newly diagnosed, recurrent, spread or continuation of cancer after the initial cancer claim), stroke, heart attack and other heart-related diseases (including coronary artery bypass surgery or other serious coronary artery diseases). Please refer to the Policy Terms and Conditions and Exclusions for details

- ⁵The data is from a reinsurance company's major disease survey conducted in the Asian region from 2008 to 2012 and Bowtie market research

- ⁶The calculation is based on the average premium for a 10-year, 1 million coverage policy for a 25-year-old non-smoking male. The price difference is as high as 59.39%

- ⁷Referring to data from 10Life, a Hong Kong insurance information and comparison platform.

- ⁸Based on the data from the Hong Kong Cancer Registry of the Hospital Authority [Accessed in June 2023] and calculated by the "cumulative risk" formula

- ⁹Referring to the "2020 Breast Cancer Statistics for Women" published in October 2020, by the Hong Kong Cancer Registry, Hospital Authority

- ¹⁰Referring to data cited by the non-profit charity organization, Care For Your Heart, quoting statistics from the Hong Kong Medical Association

- ¹¹If a claim is made for a severe critical illness within the early critical illness waiting period, and the early critical illness benefit has already been paid out or is eligible for payment, we will pay the remaining coverage amount as severe critical illness benefit. In other words, for claims related to both the early critical illness benefit and severe critical illness benefit under this series, we will pay a total amount equivalent to 100% of the coverage amount

- ¹²For details, please refer to theTerms and Conditions of Bowtie's December limited-time promotion