As a matter of fact, many startups do not have the same level of resources as multinational companies with substantial financial resources, so the HR (human resources department) of these startups or small and medium-sized enterprises (SMEs) must do everything they can to make their companies more appealing and to retain talents.

According to a survey conducted by Glassdoor, a leading business review site, it turns out that the most important thing to employees is whether the company can provide comprehensive group medical insurance. Compared to that, paid leave, pensions, etc. are only taken as secondary concerns. Bowtie is aware of the limited budgets of the SMEs and decides to offer the great value-for-money Corp Medical Insurance Plan, with lower premiums than traditional insurance companies, for example, a minimum of HK$98 per person per month for multiple benefits including outpatient, surgery, dental treatments, and body check. You may retain your most valuable employees by taking into account operating costs and employee expectations.

How to choose a group medical insurance?

Here are the 2 most important factors for consideration.

1. How much protection is sufficient?

There is no absolute answer to this question. After all, the situation varies from company to company, and the employer or HR needs to consider factors such as overall budget and the needs of the employees. However, it should at least be enough to pay for a general practitioner visit and medication (about HK$250 to HK$300) and to cover the cost of minor inpatient surgery, such as the commonly performed hemorrhoidectomy, which costs about HK$27,000 to HK$51,000.

Many insurance companies offer group medical insurance plans specifically designed for SMEs, with coverage and premiums clearly stated, thus avoiding a lot of unnecessary trouble.

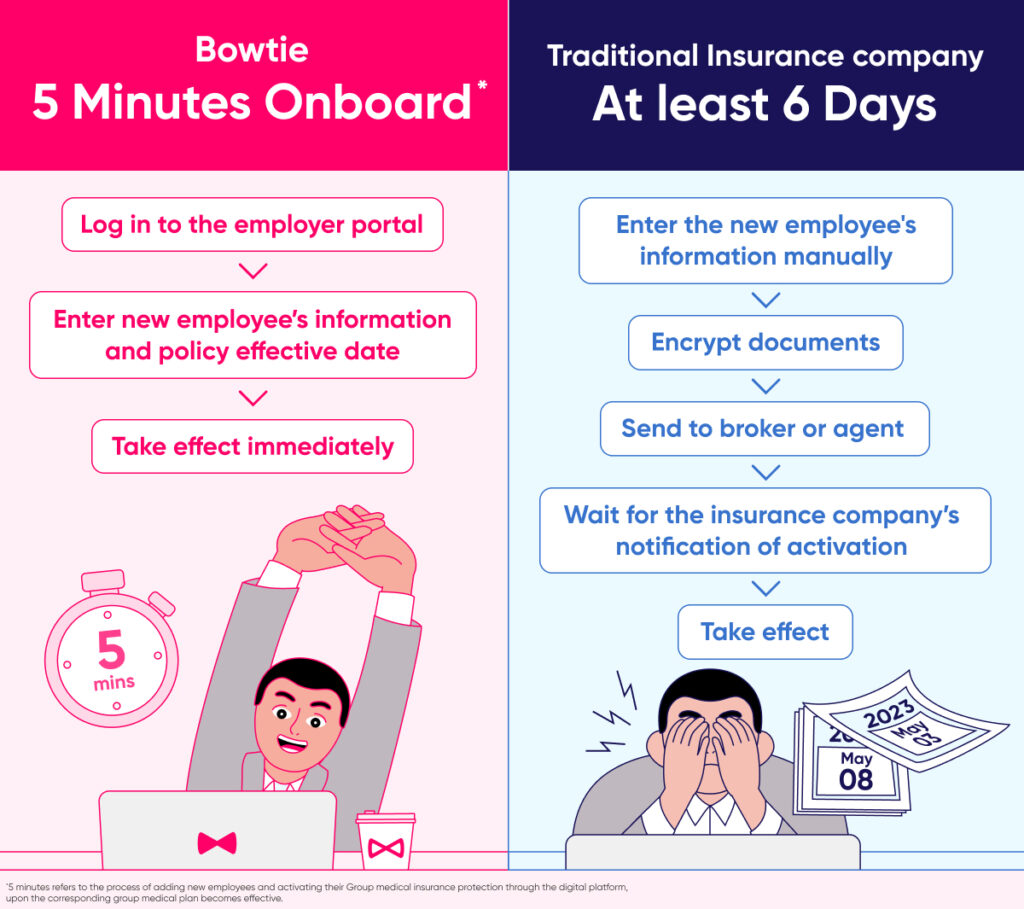

2. Are there any HR resources to handle medical insurance for employees?

While large companies usually hire a specialist to handle matters related to benefits for their employees, SMEs or start-ups are less resourceful and may not be able to allocate much time and manpower to handle these administrative procedures. Therefore, instead of wasting time researching how to match basic items with additional coverage, it is much better to choose a comprehensive and pre-designed policy plan and then concentrate all of your tactics and efforts on expanding the business.

If your company does not have the manpower to assist employees in handling claims, choose a medical insurance plan that “everyone knows how to make his or her own claims”. Hence, it is best to learn about the claim process of the insurance company before applying for a policy. And you should opt for those insurance companies that offer an online claim platform.

To learn more about what to consider before applying for group medical insurance, please click here for more information.

Bowtie Corp Medical Insurance Plan: 6 plans and corresponding protections

There are 6 levels under Bowtie Corp Medical Insurance Plan, namely Basic Bronze, Basic Silver, Basic Gold, Pro Bronze, Pro Silver and Pro Gold, which are basically listed in the table below.

| Basic Bronze | Basic Silver | Basic Gold | Pro Bronze | Pro Silver | Pro Gold | Pro Platinum | |

| Premium* | $10 | $98 | $198 | $388 | $488 | $598 | $798 |

| Life Insurance coverage | $3,000 | $25,000 | $50,000 | $25,000 | $50,000 | $80,000 | $120,000 |

| Inpatient and day case procedures (Reimbursement of 80% of medical expenses) | X | $25,000/year | $50,000/year | $25,000/year | $50,000/year | $80,000/year | $120,000/year |

| General practitioner | Up to 50% off (Applicable to BowtieGo Medical Network) | $420/visit** | $420/visit** | $420/visit** | $420/visit** | ||

| Chinese medicine practitioner | $270/visit** | $270/visit** | $270/visit** | $270/visit** | |||

| Dental treatment | $500/visit** | $500/visit** | $500/visit** | $500/visit** | |||

| Specialist | $690/visit** | $690/visit** | $690/visit** | $690/visit** | |||

| Physiotherapist (with written referral by a Registered Medical Practitioner) | Up to 50% off (Applicable to BowtieGo Medical Network) | $600/visit** | |||||

| Chiropractor (with written referral by a Registered Medical Practitioner) | $600/visit** | ||||||

| Diagnostic imaging and laboratory tests (with written referral by a Registered Medical Practitioner) | X | X | X | $500/year | $500/year | $1,500/year | $2,500/year |

| Body check | X | Full coverage*** | Full coverage*** | Full coverage*** | Full coverage*** | Full coverage*** | Full coverage*** |

| Eligibility^ | Employee, spouse, parents, children | Employee, spouse, children | Employee, spouse, children | Employee, spouse, children | Employee, spouse, children | Employee, spouse, children | Employee, spouse, children |

- *Monthly calculation per person

- **Up to 30 outpatient/dental visits per policy year. Up to 1 visit per day; the maximum benefit amount per visit/$30 deductible per visit.

- ***Once per policy year

- ^Age restrictions for certain plans

Why is Bowtie the perfect choice for startups and SMEs?

1. Online processing, without the need to contact an agent/ broker

Bowtie makes the entire process, from application to claim, available online. If a claim is needed, the employees do not have to contact an agent/ broker to pick up the documents. They can simply log in to the easy-to-use one-stop platform and submit the application and check the progress on their own.

2. No referral letter needed for specialist care

If the claim involves physiotherapy or specialist treatment, normally the insurance company will request a referral letter from the practitioner for a one-time use basis only. But Bowtie Corp Medical Insurance does not require a referral letter. The Basic Care Series (Basic Bronze, Silver, and Gold plans) offer privileges for up to 24 kinds of specialist outpatient services at member-only rates, saving you the effort of making multiple claims. Those who upgrade to the Pro Care Series (Pro Bronze, Silver, Gold, or Platinum plans) can enjoy even better specialist coverage, as they are free to visit their preferred clinics without the restrictions of any medical network or referral letter.

3. Enjoy outpatient/dental treatment, even diagnostic imaging, and laboratory test coverage for only HK$30 per visit

Bowtie Basic Care plans do not have coverage limits for outpatient and dental coverage, which means that the insured can enjoy unlimited visits to reduce daily medical expenses. In addition, when presenting the designated QR code at Bowtie GoNetwork, the insured can instantly enjoy as low as half price for outpatient visits^ without the need to file a claim or present a physical medical card, making it convenient and fast.

For Pro Care Series (Pro Bronze, Silver, Gold, and Platinum plans) with different coverage limits, the insured can enjoy medical services such as general outpatient, Chinese medicine outpatient, dental treatment, specialist outpatient care, etc. with only HK$30^ deductible per visit.

The Pro Platinum plan maximises the coverage for the insured person, with HK$30^ deductible for physiotherapy and chiropractic treatment#, and diagnostic imaging and laboratory tests# up to HK$2,500 per year!

4. The 10 major guarantees for $600 only per month

Bowtie Corp Medical Insurance offers a wide range of excellent value-for-money plans. With monthly premiums ranging from HK$98 to HK$598 per person, these insurance plans, covering life insurance, inpatient and day-case surgery, general outpatient, specialist outpatient, Chinese medicine outpatient, dental treatment, physiotherapy, chiropractic treatment, diagnostic imaging and laboratory test, body check, and flu vaccines, suit the different needs of employees.

Since all plans are offered in the form of packages and the technology helps to reduce the cost, the premiums are lower and the value-for-money is extremely high.

5. Parents and children can also enjoy the benefits

Many group medical insurance policies cover only the employees, but not their spouses, parents, and children. WIth Bowtie Corp Medical Insurance, employers and employees have the option to extend coverage to protect employees’ family members as well if eligible.

- #A written referral from a registered medical practitioner is required

- ^The actual amount depends on the practitioner and the specific needs of medical treatment.

If you are interested in applying for Bowtie Corp Medical Insurance for SMEs and start-ups, please visit our Bowtie page to drop us a line and leave us your contact details, or contact us by email at cs@bowtie.com.hk. You can also call us at 3008 8123 or contact us via WhatsApp for more information instantly.