In Hong Kong, you can buy life insurance through various channels, including:

- directly online from an insurance company

- through an intermediary (an agent or broker)

- through a bank

- through an online comparison site

How do these channels differ? What are the pros and cons? Read on to find out the best way for you to purchase a life insurance!

| Directly online from an insurance company | Through an intermediary | Through a bank | Through an online comparison site |

| Provides a broad selection of life insurance products | Fewer | Broker: more; Agent: fewer | Fewer | More |

| Requires the payment of commissions (included in the premium) | ✘ | ✔ | ✔ | Depends on the company |

| Analysis of coverage needs by specialists | ✘ | ✔ | ✔ | ✘ |

| Apply anytime, anywhere | ✔ | ✘ | ✘ | Depends on the company |

| After-sales customer service | ✔ | ✔ | ✔ | Depends on the company |

1. Directly from an insurance company

| Insurance Company |

| Life Insurance Products Available | Own-brand life insurance products, primarily pure life insurance (i.e. Term Life) |

| Sales Model | Customers apply online. |

| Needs Analysis (e.g. Policy Type or Sum Insured) | Customers must read about each life insurance product on their own before coming to their own decisions. |

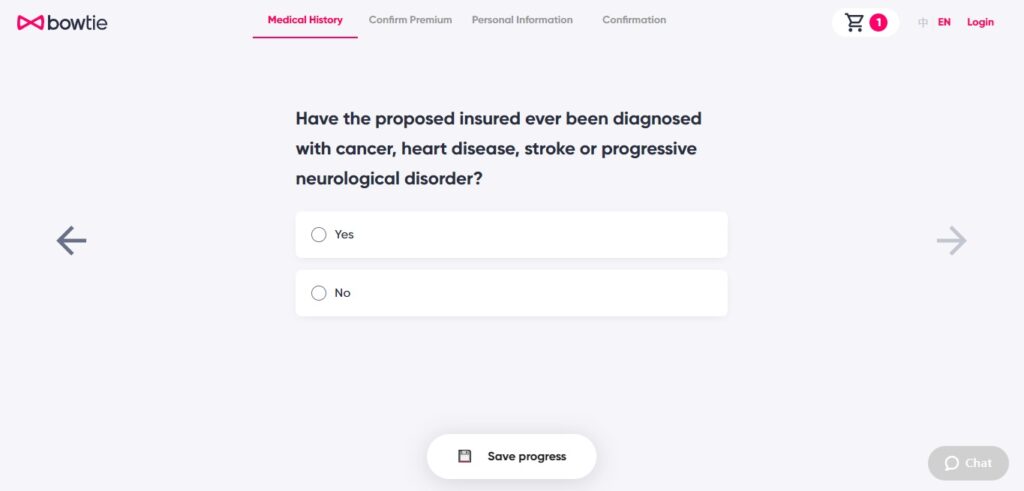

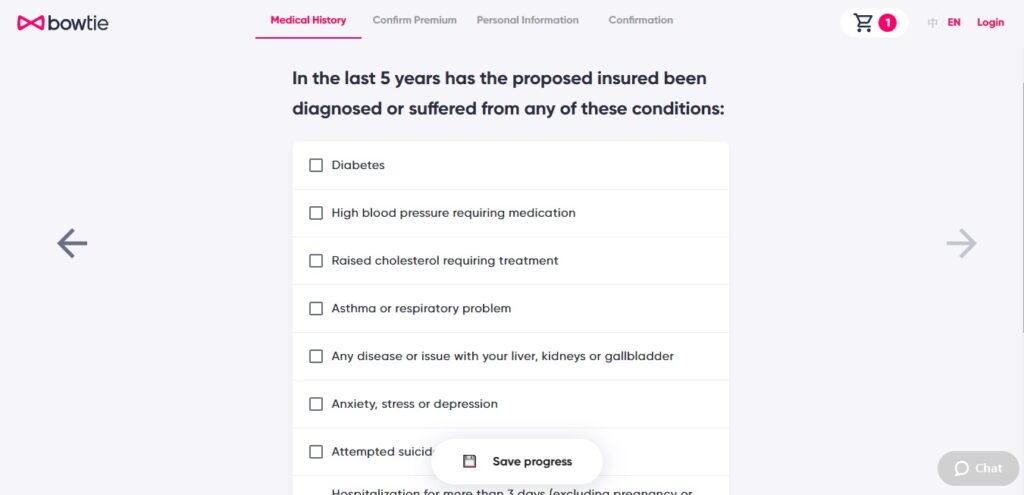

| Underwriting Procedure | - The insured must declare their health status through an online underwriting system (mainly multiple-choice questions).

- For virtual insurers, like Bowtie, for example, a health exam is not necessary. Instead, around 80% of cases are handled by the automated underwriting system; around 20% of cases with more complex medical records are handled by underwriters.

|

| Payment Methods | Take Bowtie, for example- Payment method: Bowtie policyholders can select a preferred credit card

- Premium billing: Premium charged monthly to the designated card

- Settlement currency: Premiums are settled in HKD

|

| After-sales Customer Service | Service provided by the virtual insurance company’s customer service department |

Pros & Cons

| Pros | - Payment of commission not needed, lower premiums

- Information transparency:

Information about each insurance product, including price, coverage, and policy, can be found on the website, making it easy for consumers to make comparisons.

- Discount offer for application leaps to the eye:

Virtual insurers usually present discounts for applications in an easily decipherable way for their customers, who must apply online.

- Customers are not subject to sales pressure:

All products are sold online without intermediaries. As a result, consumers are not put under any sales pressure.

- Customers can apply anytime, anywhere: With internet access, customers can apply anytime, anywhere.

|

| Cons | - Customers have to study each life insurance product on their own and compare the pros and cons. While this might take time and effort, it helps customers understand their policy and coverage.

- The insured has to manage their policy and claims on their own. However, the insurer’s customer service can provide timely assistance.

|

2. Through an intermediary

| Through a Broker | Through an Agent at an Insurance Company |

| Life Insurance Products Available | Different banks and insurers provide a broad range of life insurance products, including cash value/ pure life insurance. | A broad range of life insurance products, including cash value/ pure life insurance, are offered by the insurance company represented by the agent. |

| Sales Model | One-to-one active sales |

| Needs Analysis (e.g. Policy Type or Sum Insured) | Typically, intermediaries conduct the needs analysis for the customers. |

| Underwriting Procedure | - The insured has to declare their health status.

- In specific cases, for instance, where the insured is advanced in years or has a severe pre-existing condition, the insured has to undergo a health exam.

- The intermediary submits the insured’s declared information to the insurer’s underwriting department and awaits the underwriting outcome.

|

| Payment Methods | Payment methods:- Cash, checks, bank transfers, cashier’s checks, credit cards, PPS, autopay, online banking, FPS, Payme

Premium billing: - Lump-sum, monthly, quarterly, semi-annually, annually

Settlement currency: - Premiums can be settled in Hong Kong Dollars (HKD) and foreign currencies, most commonly, U.S. Dollars (USD). The same currency for payment of insurance premiums is used for the settlement of claims.

When purchasing an insurance policy through a broker, you make your premium payment to the broker’s agency, after which the payment is made to the insurer by the broker. When purchasing an insurance policy through an agent, you make your premium payment directly to the insurer. |

| After-sales Customer Service (including Claims) | Service primarily provided by the intermediaries |

Pros & Cons

| Pros | - Intermediaries can help explain and assess your insurance needs

- Various options available for each type of insurance

- After-sales service, including filing a claim for the insured

|

| Cons | - A commission is payable when an intermediary is involved, thus higher premiums

- Customers may feel sales pressure from the intermediaries

- Quality of after-sales service depends on intermediaries’ capabilities and sense of responsibility

- Since the intermediary handles most arrangements, the insured might not be familiar with their policy coverage, insurance combination, and even the claims procedure.

|

3. Through a bank

| Bank |

| Life Insurance Products Available | - Life products offered by the bank-affiliated insurance company

- Some banks do not have an affiliate, and they sell life insurance products issued by other insurers.

|

| Sales Model | One-to-one active selling by licensed insurance consultants |

| Needs Analysis (e.g. Policy Type or Sum Insured) | Licensed insurance consultants conduct the needs analysis for the customers. |

| Underwriting Procedure | - The insured has to declare their health status.

- In specific cases, for instance, where the insured is advanced in years or has a severe pre-existing condition, the insured has to undergo a health exam.

- The licensed insurance consultant submits the insured’s declared information to the bank’s underwriting department.

|

| Payment Methods | Payment methods: Bank account transfers, checks or credit cards Premium billing: - Lump-sum, monthly, quarterly, semi-annually, annually

Settlement currency: - Premiums can be settled in Hong Kong Dollars (HKD) and foreign currencies, most commonly, U.S. Dollars (USD). The same currency for payment of insurance premiums is used for the settlement of claims.

- Premiums are paid to the bank account opened by the insurance company at the bank

|

| After-sales Customer Service | Any bank branches can provide services |

Pros & Cons

| Pros | - Insurance consultants can help explain and assess your insurance needs

- After-sales service can be provided by any bank branches: If the insured has bought the policy through the bank, they can go to any bank branches for inquiries or fill a claim.

|

| Cons | - Commissions or operating costs contribute to higher premiums

- After-sales service can only be provided during the opening hours of the bank branches. If the insured seeks help outside these hours, they may not receive timely assistance.

|

4. Through an online comparison site

| Online Comparison Site |

| Life Insurance Products Available | As a third-party platform, an online comparison site offers products that it jointly markets with different insurance companies. |

| Sales Model | Passive sales: Once a customer has chosen a life insurance product, the website either transfers the insurance application to the insurer’s website or get in touch with the insurer’s licensed insurance consultants. |

| Needs Analysis (e.g. Policy Type or Sum Insured) | - Customers can first examine the features of each life insurance product, compare and analyze them.

- Depending on the insurance policy chosen, some insurers assign an agent to follow up, while others only allow online applications.

|

| Underwriting Procedure | Depending on the insurer chosen by the customer, the underwriting procedure may differ in terms of: - how customers declare their health status

- whether health exam is needed

- the methods and criteria for gaining approval

|

| Payment Methods | Depends on the insurer chosen by the customer |

| After-sales Customer Service | These sites do not offer after-sales service. Instead, it is provided by the insurer. |

Pros & Cons

| Pros | - Information transparency: Consumers can easily compare the price and coverage of each insurance product before choosing the one most suited to their needs.

- Discount offer for application leaps to the eye: Insurers’ instant discounts or luck draws are listed.

- Customers are not subject to sales pressure.

|

| Cons | - More time-consuming: Although these sites already work to render information more intelligible, without the help of intermediaries, customers still have to spend a considerable amount of time studying the complex provisions of different life insurance policies.

|

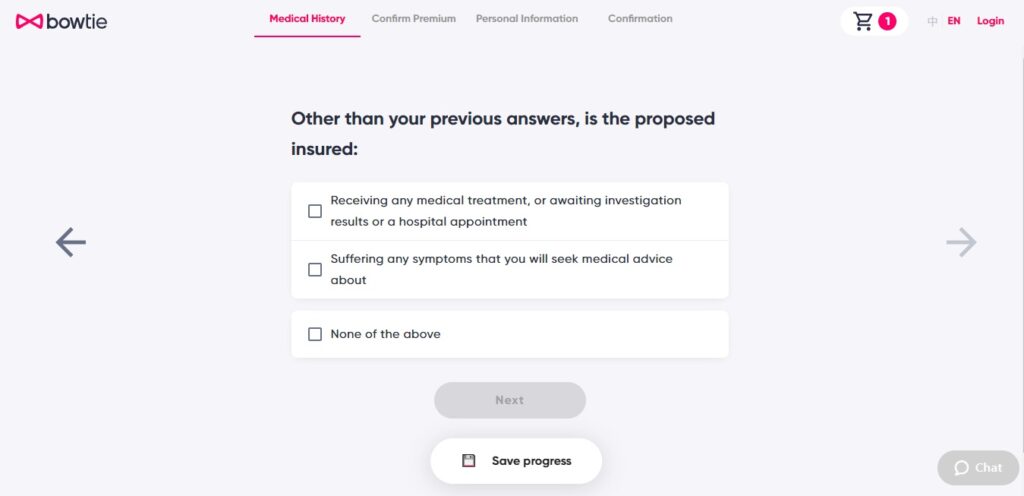

Bowtie’s pioneering online underwriting system is fully accessible by the web. Apart from filling out basic personal information, it only requires answering 3 health-related multiple-choice questions.

If you have any underwriting-related questions, you may approach Bowtie specialists for online support. Just click on “Let’s Talk”!

For traditional insurance companies, underwriting takes three weeks or more to complete. On top of that, a health exam is required in certain cases. Conversely, Bowtie’s streamlined underwriting process only takes 10 minutes to complete. As a result, not only can our customers find out right away if their application has been successful and the premium costs, they also can access their projected annualized premiums in the next 5 years!

Let's try our instant quotation!

Author

The Bowtie Life Insurance Company Limited is an authorized life insurance company and Hong Kong’s very first virtual insurer approved. Through the use of modern technology and medical expertise, Bowtie offers an agent-free, commission-free and more convenient online platform for customers to quote, apply and claim for Voluntary Health Insurance Scheme (VHIS) anytime anywhere. Bowtie is ranked first in the direct channel sales throughout 2021.

Stay up to date at

www.bowtie.com.hk