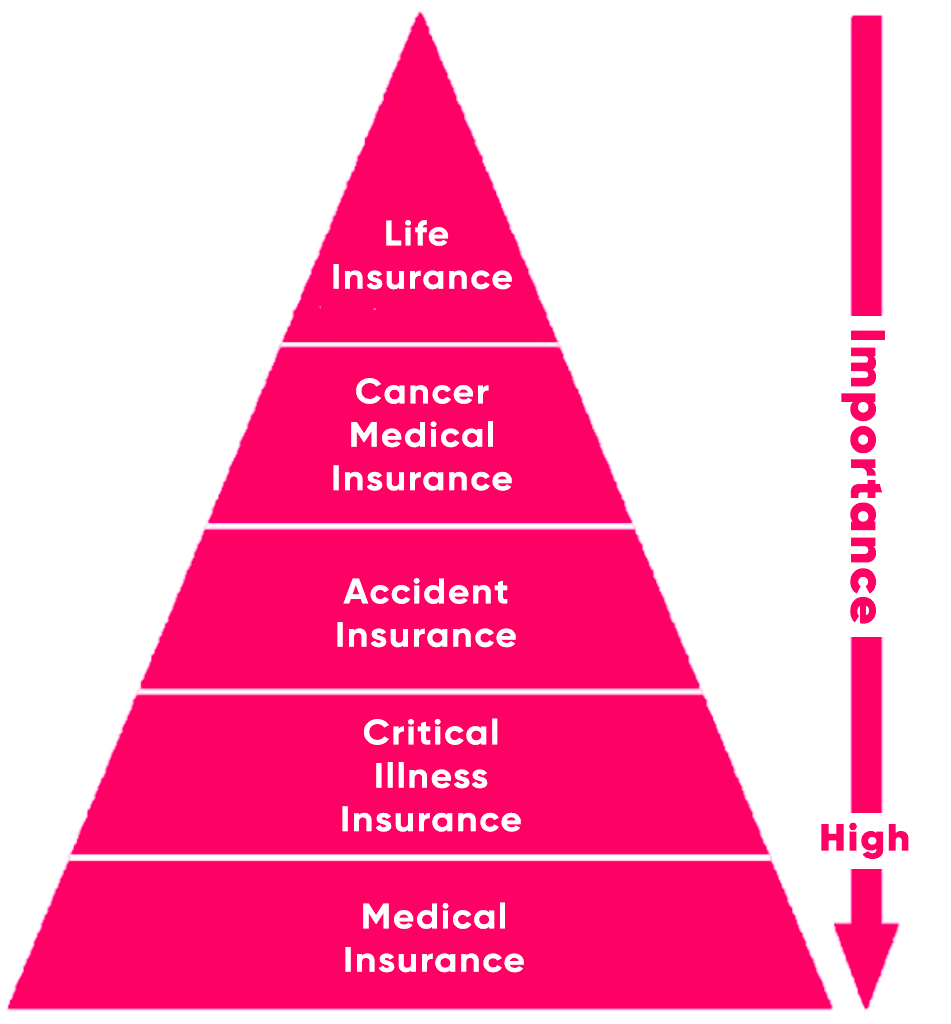

What insurance do children need?

1. Medical Insurance

What are the key considerations when choosing medical insurance for children?

Most parents have experienced the helplessness of taking care of a sick child. Since children have weaker immunity, they often get sick. Therefore, it’s important to be prepared with sufficient medical insurance so that they can get the best treatments possible.

When choosing medical insurance plans for your children, there are 3 important considerations:

a. Outpatient Benefit

Children are still developing their communication skills and can hardly explain their sicknesses and feelings to adults. Therefore, parents should monitor closely and seek professional medical advice as soon as possible especially in case of fever.

Different insurance companies define outpatient medical expenses differently. Generally, outpatient medical insurances cover general practitioner and specialist consultation fees with some extended coverage such as Chinese medicine, physiotherapy, chiropractic and Chinese orthopaedic treatments. Some insurance plans even cover prescribed western medicine, X-rays, laboratory tests, speech therapy, day-surgery and more.

b. Medical Network

In addition to the number of illnesses/ treatments covered, the medical network is also vital . The number of doctors in a medical network can range from 200 to 2000. If you have special preferences for doctors or hospitals, then it’s even more crucial to carefully check if the list of doctors provided by the medical insurance is suitable for you and your child.

c. Hospital Companion Bed Allowance

If a child is admitted to the hospital, the parents often opt to stay overnight to keep the child company in the unfamiliar environment. While hospitals generally allow parents to accompany their children for 24 hours with additional fees. That’s why insurance plans that offer hospital companion bed allowance are preferred so that medical expenses are kept to the minimum.

VHIS provides protection and tax deductions

Unlike traditional medical insurance, VHIS plans must be approved by the Food and Health Bureau before launch. The terms and conditions of VHIS are standard, transparent and designed to fit most consumer’s needs.

VHIS benefits not only the children (the insured) but also the parents (the policyholder) because of the tax deduction. According to the tax regulations, taxpayers can apply for deductions if they purchase VHIS for themselves and family members. The maximum tax deduction for each insured person is up to HK$8,000. Since there is no limit on the number of insured people, the more VHIS plans you buy, the more taxes you save.

| Insured Person | Annual Premium | Tax Deduction for Premiums Paid | Tax Savings (Assuming 15% Tax Rate^) |

| Father | HK$5,000 | HK$5,000 | HK$750 |

| Mother | HK$5,000 | HK$5,000 | HK$750 |

| Son | HK$1,536 | HK$1,536 | HK$230 |

| Daughter | HK$1,248 | HK$1,248 | HK$187 |

| Total | HK$12,784 | HK$12,784 | HK$1,917 |

- ^The standard tax rate for 2018/19 tax year is 15%, while the marginal tax rate is 2%, 6%, 10%, 14% and 17%. Information source: The Food and Health Bureau (updated on 21 May 2019). The “taxpayer” mentioned above is the policyholder. Above content is for reference only. For tax filing recommendations, please consult with your tax advisors.

Can children with SEN get insured?

The Education Bureau categorizes Special Education Needs (SEN) into 9 types, namely, specific learning difficulties (SpLD), attention deficit/hyperactivity disorder (AD/HD), autism spectrum disorders (ASD), speech and language impairment, intellectual disability, hearing impairment, physical disabilities, visual impairment and mental illness.

Every rehabilitation treatment is critical to the development for SEN students. Since each child’s needs are different, SEN students usually need to undergo assessment before the treatments and support are provided.

According to statistics from the Special Learning Needs (SEN) Rights Association, over 60% of children suspected to have special education needs need to wait for 1 to 3 years or more before receiving assessment from the public hospital. The waiting time at private hospitals is much shorter but the assessment fees are expensive, ranging from $5,000 to $8,000. Hence, due to financial constraints, some parents are left with no choice but to wait for public hospital assessment.

Insurance companies generally classify learning disabilities as conditions caused by brain and nervous system development. With other unknown issues, people with SEN are considered a high-risk group and are not covered by insurance. In other words, even if the parents would like to purchase insurance for their children with SEN, they will likely be denied.

However, VHIS can provide protection for children with SEN if their learning disabilities are caused by congenital or genetic diseases, and the onset of the disease happens at age 8 or after. In recent years, some insurance companies have relaxed the terms and listed some types of learning disabilities such as autism and ADHD as early-stage critical illnesses, allowing policyholders to claim benefits.

2. Lump-sum Payment Critical Illness Insurance

Would children get critical illnesses?

Many people think children don’t get critical illness, but is that the case?

In fact, there is no age limit when it comes to illnesses. Parents should never be misguided to think that children are not vulnerable to becoming seriously ill. In the unfortunate event that a child’s health is in danger, an insurance plan will be tremendous help to the whole family.

Currently, critical illness insurance does not cover congenital critical illnesses, however, VHIS does. As long as the insured person is diagnosed at age 8 or older, VHIS will cover it. In other words, if the child develops a serious illness between ages 0 and 7, parents may have to bear the large amount of medical costs without help from insurance, not to mention the additional expenses of professional counselling, education and other associated services.

There are dozens of critical illness insurance plans in the market, with different premiums and terms. If you compare them carefully, you will find a plan that suits your needs. This way, even if an unexpected event happens, there will be adequate financial protection allowing your children to receive the best care possible and increase the effectiveness of treatments and probability of full recovery.

Best Combination: Medical + Critical Illness Insurance

For those with financial constraints, reimbursement medical insurance plans for children would be sufficient. But if conditions allow, it’s recommended to also purchase critical illness plans to provide additional protection.

Lump-sum payment from critical illness insurance allows more cash flow. For example, parents can use the money from insurance to pay for better treatment plans for their child, hire qualified nurses to help with the child’s daily life, or purchase specialized equipment to assist with rehabilitation. Even if the parents quit their jobs to take care of the child full time, critical illness insurance can provide financial support for the living expenses and lessen the financial burden.

Simply put, medical insurance is a basic necessity. If finances allow, adding critical illness insurance on top would provide more comprehensive protection and flexibility for the family.

3. Accident Insurance

Children are constantly exploring and learning. In the process of their new discoveries, there are inevitably a few bumps and falls or accidents. It’s hard to predict the severity of their accidents. The minor ones may just be sprains or skin abrasions. If unlucky, the more severe ones could be fractures, spinal injuries or worse.

Active child need Accidental Insurance the most

Has your child ever had an accident? It’s great that children are active but that means they may also need to be well protected. Especially children can hardly tell when they are in danger and hence, accidents can happen often.

Whether it’s cycling, playing football or playing at home, accidents can happen anywhere. In the unfortunate event of a fracture, treatments at private hospitals start at around $30,000 plus additional miscellaneous fees. Public hospital treatments costs are a lot lower, however, the waiting time for orthopaedics can be as long as 3 years.

According to a study by the University of Hong Kong, there are 5,000 children in Hong Kong every year on average involved in accidents and require emergency medical services. Within those cases, boys aged from 0 to 4 are particularly at risk. Therefore, it’s highly recommended to purchase accident insurance for children. For only around $40 a month, you can get protection for all accident related medical expenses within 12 months after an accident.

4. Cancer Medical Insurance

Consider to purchase insurance for specific illnesses

Is there a hereditary disease that runs in your family? Modern science has proved that many illnesses are related to genetics.

Take cancer for example. Breast, ovarian, colon and prostate cancer are common hereditary diseases. With varying onset periods for different people, it’s unpredictable when these genetic diseases will strike.

There are critical illness insurance plans that cover over 100 illnesses (which sound a lot),; there are also medical insurance plans that cover specific illnesses such as the 3 key critical illnesses including cancer, heart disease and stroke.

If you value quality over quantity, then the insurance plans that provide direct coverage for your family would be more suitable.

Critical illness insurance usually covers only 1 diagnosis and the policy will terminate once the claim is complete. However, cancers have a high chance of recurrence, if the insurance plan covers you for only one diagnosis, then it may not be the best choice. If you worry that the cancer may recur or other cancers may strike, then it’s worth considering buying a cancer medical insurance plan.

For example, within Bowtie’s Cancer Fighter plan, the benefit limit for Cancer Fighter 200 and 300 resets every 3 years. Hence, cancer recurrence and diagnosis of another cancer are both covered, providing comprehensive protection for the insured.

5. Life Insurance

Adults need life insurance more than children do

The main purpose of life insurance is to provide a large amount of financial protection to support the family or dependents in the event of the death of the insured. From a financial point of view, a newborn or child does not have independent financial ability or responsibility. In the unfortunate event of a child’s death, it will not affect the family’s income.

However, if you are the family’s breadwinner and need to support your parents and children, as well as pay mortgage, then life insurance is worth serious consideration . In case of death, the loss of income will dramatically affect your family’s life. But if you had life insurance, then your family will be protected with financial support and could continue to pay for basic living expenses.

Premium overview of VHIS, Accident and Cancer Insurance

Premiums for boys

| Age | Bowtie VHIS Standard Plan | Bowtie Touch-wood (Accident Insurance) | Bowtie Cancer Fighter (Cancer Medical Insurance) (Lifetime Benefit up to $2,000,000) |

| 0 | 131 | Not Applicable | 55 |

| 1 | 128 | Not Applicable | 52 |

| 2 | 123 | 53 | 48 |

| 3 | 118 | 52 | 45 |

| 4 | 113 | 50 | 42 |

| 5 | 113 | 49 | 40 |

| 6 | 104 | 47 | 37 |

| 7 | 95 | 46 | 34 |

| 8 | 90 | 46 | 33 |

| 9 | 87 | 45 | 32 |

| 10 | 86 | 45 | 31 |

Premiums for girls

| Age | Bowtie VHIS Standard Plan | Bowtie Touch-wood (Accident Insurance) | Bowtie Cancer Fighter (Cancer Medical Insurance) (Lifetime Benefit up to $2,000,000) |

| 0 | 139 | Not Applicable | 56 |

| 1 | 134 | Not Applicable | 53 |

| 2 | 123 | 47 | 49 |

| 3 | 114 | 46 | 46 |

| 4 | 104 | 44 | 44 |

| 5 | 99 | 44 | 41 |

| 6 | 94 | 43 | 39 |

| 7 | 90 | 42 | 36 |

| 8 | 87 | 42 | 35 |

| 9 | 85 | 42 | 34 |

| 10 | 85 | 42 | 33 |

Click here to see premiums for other ages.