Application for VHIS Tax Deduction in 2023

How to Check Premium Payments

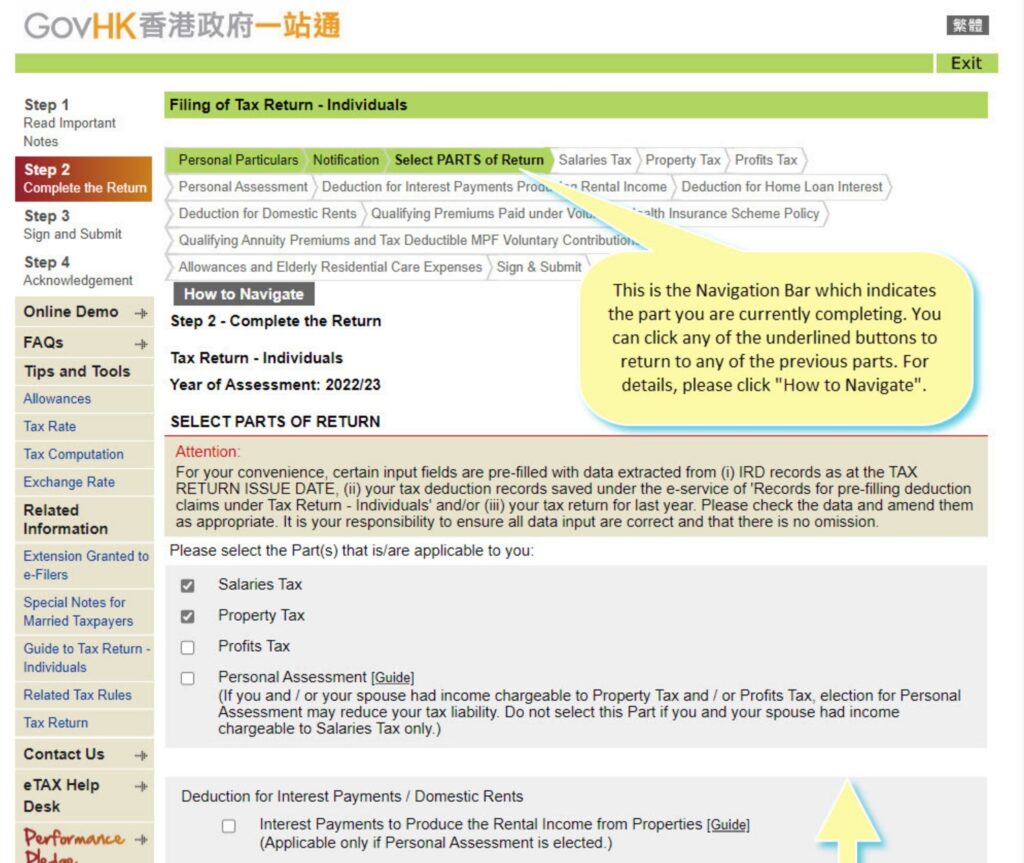

Bowtie will use screenshots from the eTAX platform to show you how to apply for a tax deduction for your VHIS premium. The same method applies to filling in physical tax returns.

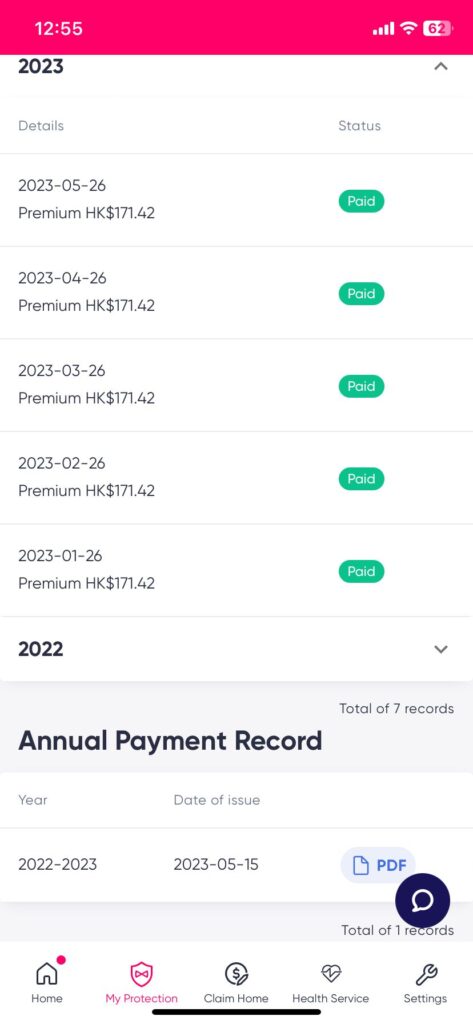

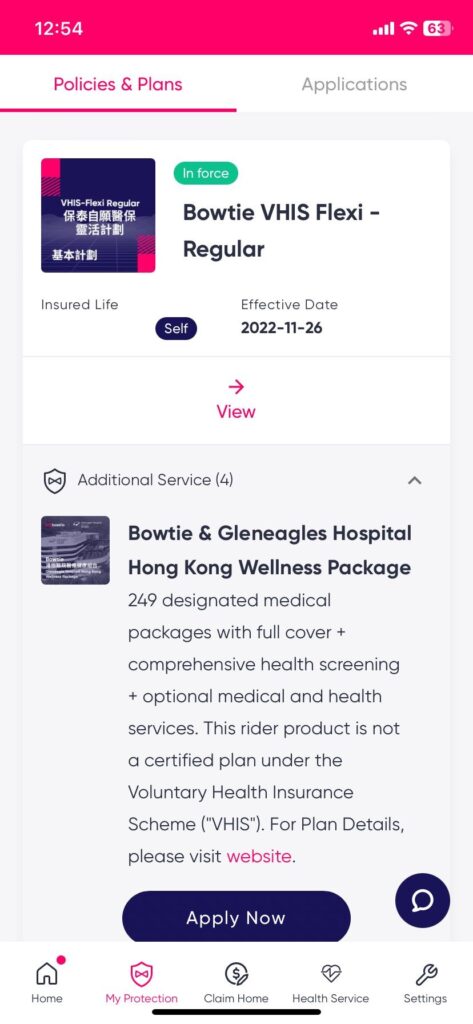

Bowtie’s policyholders can check their premium payments on the online platform.

Steps to Apply for VHIS Tax Deduction

- Log in to eTAX.

After logging in to eTAX, click on “Tax Position”. On this page, you can view the tax forms that you have not yet submitted. Simply click “Filing Tax Return” to proceed to the next page.

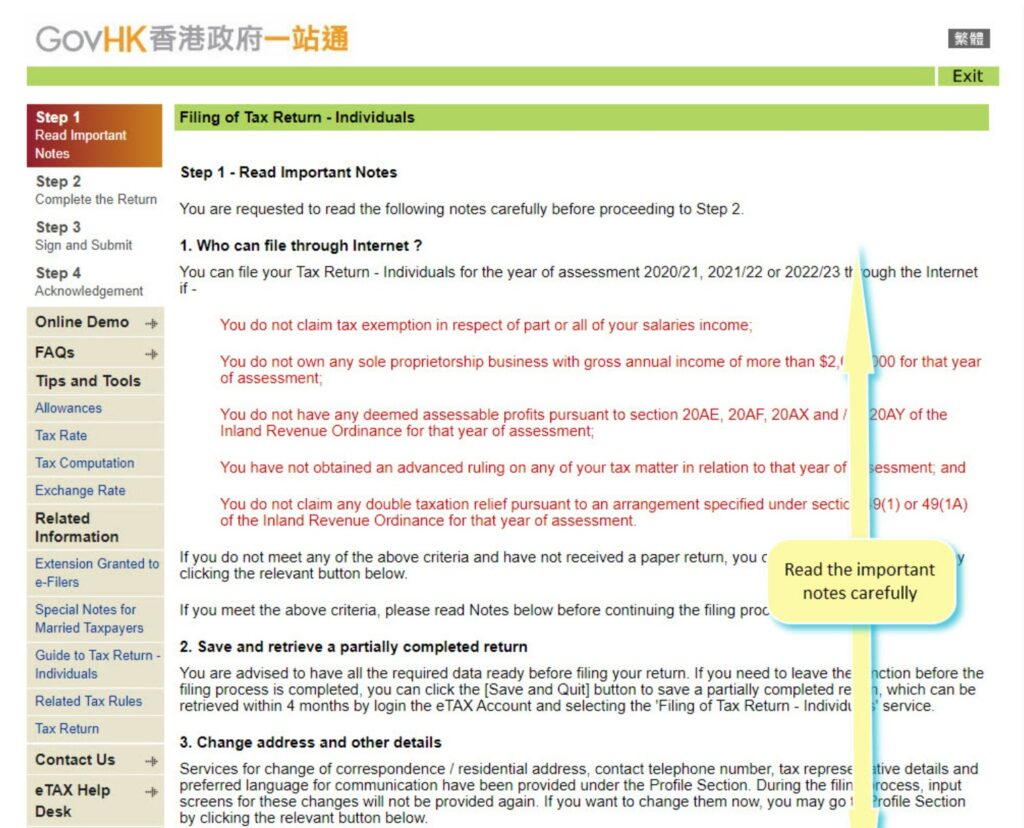

- After clicking “Filing Tax Return”, you only need to complete 4 steps:

- Read the important notes.

- Fill out the tax form.

- Sign and submit.

- Confirm submission.

After reading the important notes, click “Continue” to proceed to step 2, “Fill out the tax form”.

After confirming your personal information, check “Salaries Tax” and “Eligible premiums paid under voluntary health insurance scheme policy”.

After filling out income and other information, you will arrive at the page for “Eligible premiums paid under voluntary health insurance scheme policy”.

- If you are applying for yourself, simply fill out item (1) for “Eligible premiums paid for myself”.

- If you are paying premiums for your family members, you need to fill out item (2) for “Eligible premiums paid for specified relatives” with their personal information and premium information.

If you choose to fill out a physical tax return, the steps are the same as mentioned above, with the only difference being:

| Use e-Tax to do Tax return | Do Physical Tax Return |

| Automatic extension for submitting the tax return (= Submit within two months after receiving the tax letter) | No extension for submitting the tax return (= Submit within one month after receiving the tax letter) |

Even if you forget to mention it in your tax return, you can still apply for deferred payment of annual provisional tax by filling out form IR1121 after receiving the “Tax Demand Note”.

Documents Required for VHIS Tax Deduction

When applying for the tax deduction, you do not need to submit any documents related to VHIS, but remember to keep the premium receipts and annual policy statements for 6 years (starting from the end of the relevant tax year) for the Inland Revenue Department’s inspection at any time.

Bowtie policyholders do not need to keep receipts or annual policy statements as all documents are stored on the online platform.

FAQ about Applying for VHIS Tax Deduction

Yes, you can fill out and submit form IR831, but please note that the application must be submitted within 6 years after the end of the relevant tax year.

Yes, it will! Most insurance companies provide a 30-day “grace period” for premiums.

The “grace period” means that if the policyholder stops paying premiums for one month, the policy will still be considered valid if the premiums are paid within the grace period.

As it is well known, the last day of the tax year is 31 March. If you have paid premiums for the past 11 months but temporarily stopped paying in March and resumed in April, even if you have paid the premiums for March and April, you can only claim a tax deduction for the 11 months of premium payments. The premium payment for April should be calculated in the next tax year.

If the insurance company refunds premiums after you have submitted your tax return, you need to notify the Commissioner of Inland Revenue in writing within 3 months after the date of the refund.

If the tax assessor has already approved your tax deduction, there is a chance that the taxpayer may be subject to additional taxation.

If you have questions about annual premium payments and qualifying premiums for deductible, it is best to request a “premium certificate” from the insurance company that shows the annual premium payments, and then file your tax return based on the amount shown on the certificate!

Bowtie policyholders can view all premium payments on the online platform.